Crypto staking is becoming one of the most talked-about ways to earn passive income in the digital asset world. But what does it actually mean, and how does it benefit investors? As blockchain technology evolves, staking has emerged as an alternative to traditional mining — a greener, more accessible path to earn rewards while holding cryptocurrencies.

If you’re an investor exploring crypto for long-term wealth creation, understanding staking is crucial to making informed decisions.

What is Crypto Staking?

Crypto staking is the process of locking your cryptocurrency holdings on a blockchain network to help validate transactions and secure the network. In return, you earn rewards — typically in the same cryptocurrency you’ve staked.

Staking is only possible in Proof of Stake (PoS) or PoS-derived blockchains, such as Ethereum, Cardano, Solana, and Polkadot.

📌 Investor Insight: Staking offers yield-generating potential similar to interest-bearing instruments in traditional finance, with added exposure to asset appreciation.

How Does Crypto Staking Work?

When you stake crypto, you’re essentially delegating your coins to support network operations, such as transaction validation and block creation. Validators (akin to miners in PoW) are selected based on how many coins they’ve staked and other parameters.

If you stake via a staking pool or exchange, you don’t need to run a validator node yourself.

🛠 Staking Mechanism – Simplified Flow:

- Buy a PoS-compatible crypto (e.g., ETH, SOL, ADA)

- Transfer to a staking wallet or platform

- Choose a validator or delegate to a staking pool

- Lock your coins (lock period varies)

- Earn periodic rewards

Why Investors Are Turning to Crypto Staking

| Benefit | Explanation |

| Passive Income | Earn rewards without trading or selling crypto |

| Compounding Effect | Reinvested rewards can accelerate returns over time |

| Eco-Friendly | PoS consumes ~99.95% less energy than Proof of Work |

| Lower Entry Barrier | No expensive mining equipment or technical know-how needed |

💡 Fact Check: According to Ethereum Foundation, after Ethereum’s PoS upgrade (The Merge), global electricity consumption from Ethereum fell by 99.988%, highlighting PoS efficiency.

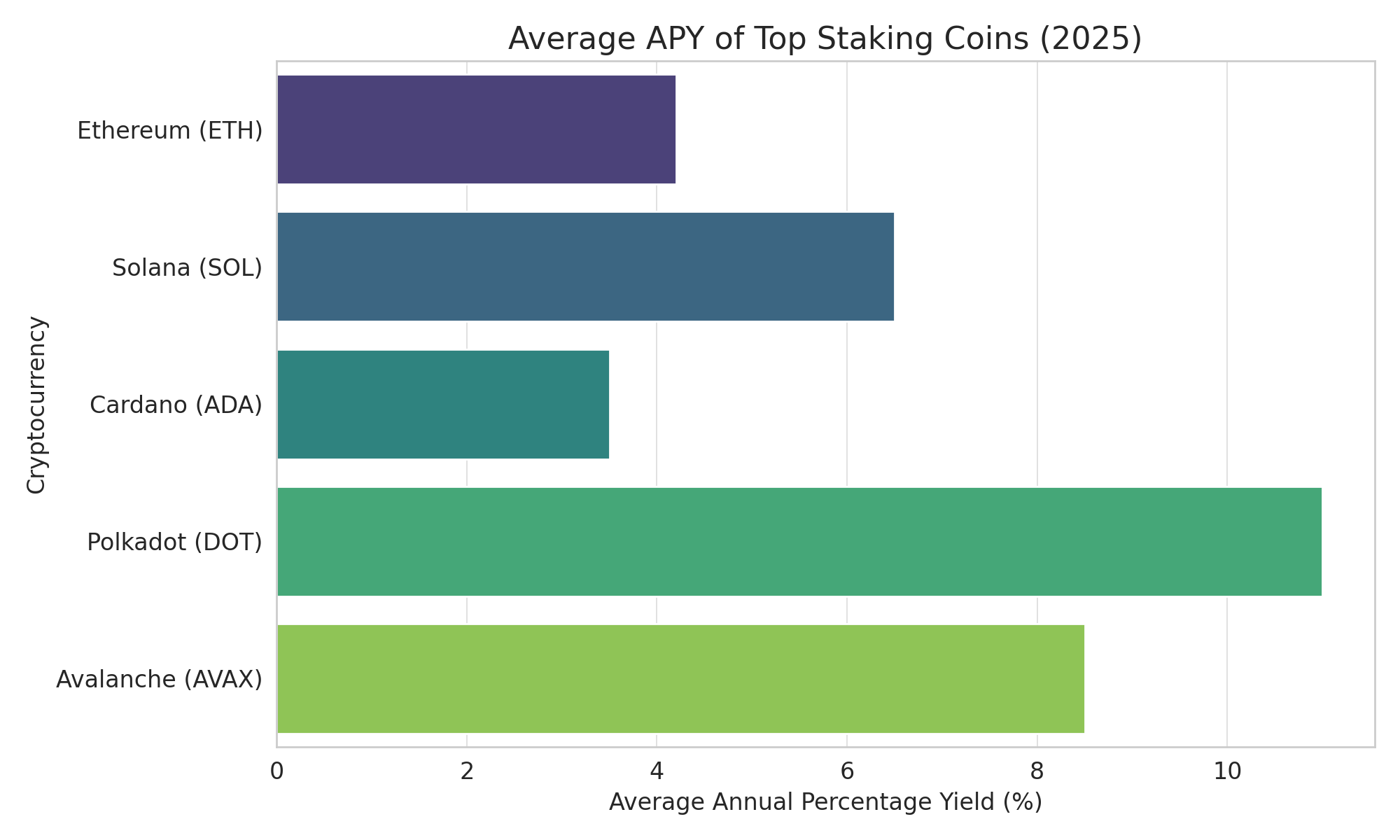

How Much Can You Earn from Staking?

Returns vary by network and platform. Here’s a snapshot of average annual staking yields (as of Q1 2025):

| Cryptocurrency | Avg. Staking Yield (APY) | Minimum Staking Requirement |

| Ethereum (ETH) | 3.5% – 4.5% | 32 ETH (solo), no min via pool |

| Solana (SOL) | 6% – 7% | No minimum |

| Cardano (ADA) | 3% – 4% | No minimum |

| Polkadot (DOT) | 10% – 12% | 10 DOT |

| Avalanche (AVAX) | 8% – 9% | 25 AVAX |

Source: StakingRewards.com

📊 Chart: Bar graph comparing APY across popular staking assets.

Types of Crypto Staking

1. Solo Staking

- Run your own validator node.

- High control, high complexity.

- Requires minimum capital and technical setup.

2. Staking Pools

- Pool your funds with other stakers.

- More accessible, lower returns after pool fees.

3. Exchange-Based Staking

- Simplest method via platforms like Binance, Coinbase, Kraken.

- Lower risk of technical errors.

- Platform may take a share of your rewards.

✅ Tip for Beginners: Start with exchange staking for ease and gradually move toward self-custody options for better control.

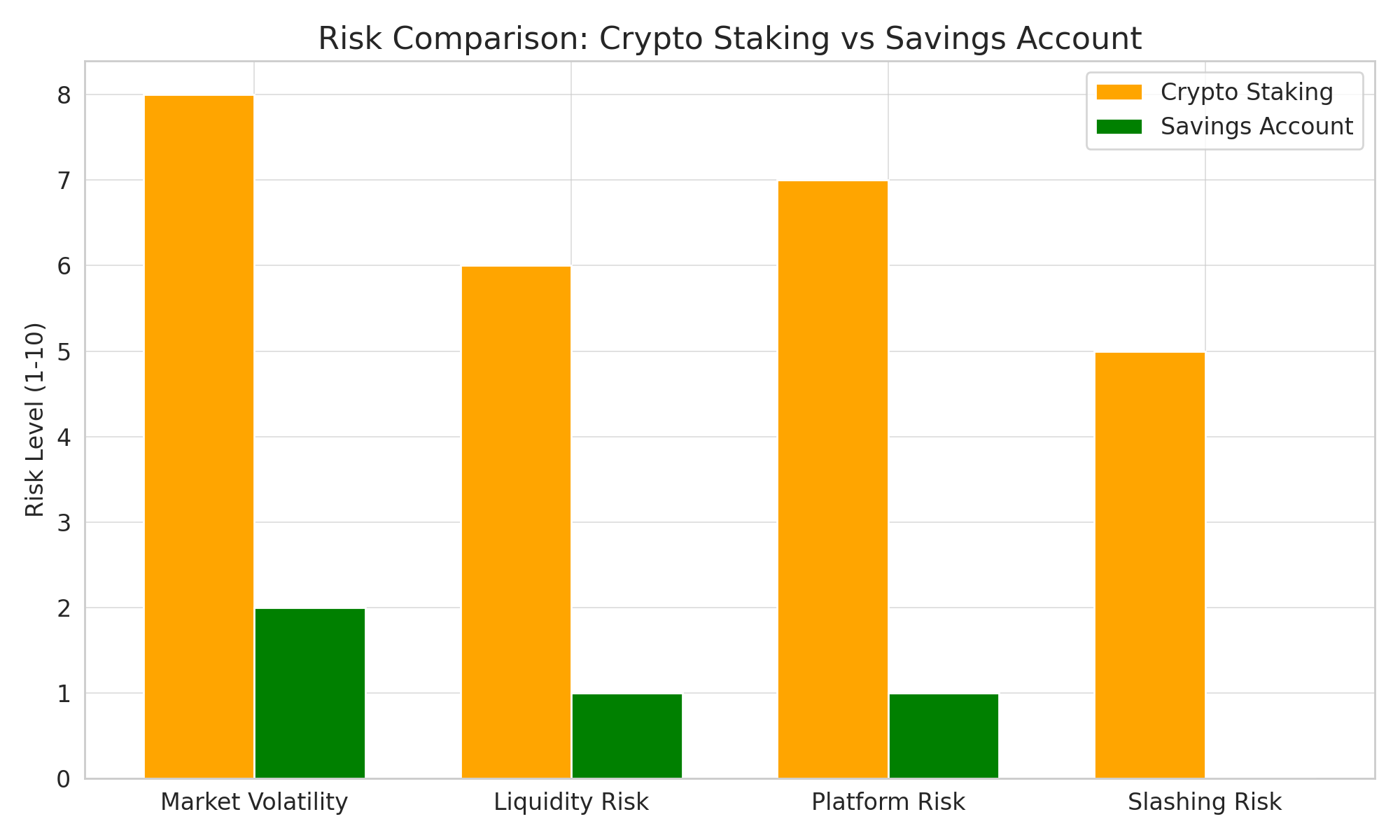

Risks Involved in Crypto Staking

| Risk Type | Description |

| Slashing | Penalty if validator misbehaves or is offline |

| Lock-up Periods | Funds may be locked for days/weeks |

| Volatility Risk | Rewards may not compensate for token price drop |

| Platform Risk | Centralized exchanges can be hacked or go bankrupt |

⚠ Investor Note: Always diversify staked assets and avoid overexposure to any one validator or platform.

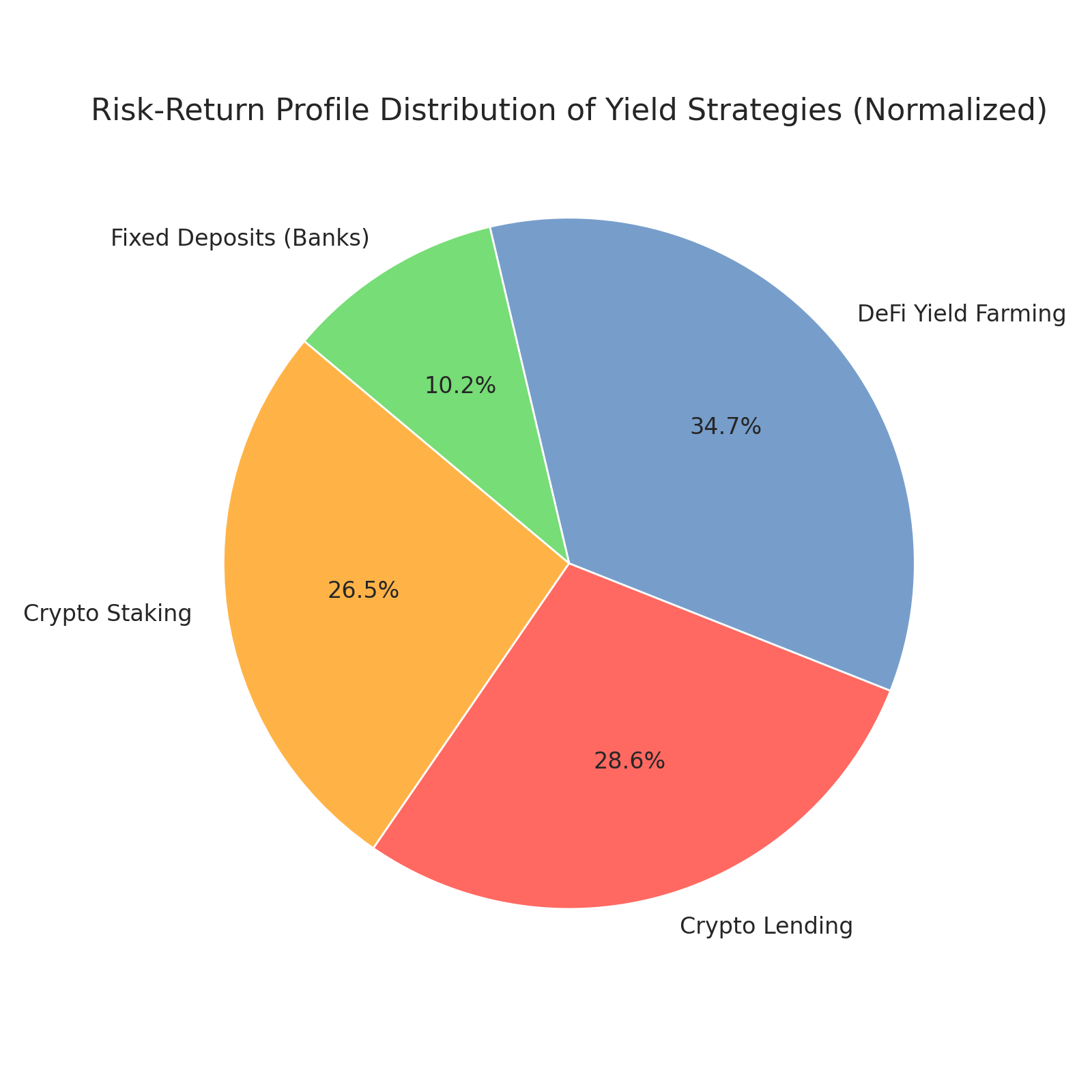

Staking vs Other Yield Opportunities

| Investment Tool | Risk Level | Reward Type | Accessibility | Liquidity |

| Crypto Staking | Moderate | Network rewards | High | Varies |

| Crypto Lending | High | Interest | High | Flexible |

| DeFi Yield Farming | Very High | LP rewards | Medium | Varies |

| Fixed Deposits (Banks) | Low | Interest | Very High | Fully liquid |

📊 Chart: Pie chart of risk-return profiles of different yield strategies.

Tax Implications of Crypto Staking

Staking rewards are considered income in most tax jurisdictions and are taxed at the time of receipt.

| Country | Tax on Rewards | Additional Tax on Sale |

| India | Taxed under ‘Other Income’ | 30% capital gains |

| USA | Ordinary Income Tax | Capital gains at sale |

| UK | Income tax rules apply | CGT applies on sale |

📌 Tip: Keep a detailed record of staking rewards and timestamps to calculate gains accurately.

Who Should Consider Crypto Staking?

- Long-term investors who believe in the project’s fundamentals.

- Risk-moderate portfolios looking for yield without trading.

- Crypto holders who want idle assets to work.

- DeFi users shifting from high-risk yield farming to stable returns.

✅ Final Thoughts

Crypto staking is not just a buzzword — it’s a powerful income-generation tool for long-term crypto investors. While rewards may seem modest compared to DeFi or trading, the risk-adjusted returns, sustainability, and network contribution make it a strong pillar of any diversified crypto strategy.

Start small, understand the risks, and gradually build your staking portfolio — it’s your gateway to passive income in the evolving Web3 economy.

Strategic Bitcoin Reserve Proposals – Click Here

FAQ

📌 1: Is Crypto Staking Worth It?

💸 Yes, absolutely — if you’re a long-term investor.

- ✅ Earn passive income without selling your crypto

- 📈 Higher returns than traditional savings

- 💼 Great for portfolio diversification

👉 Investor Tip: Stake what you plan to HODL long-term.

⚠️ 2: What’s the Downside of Staking Crypto?

🔍 Here’s what you need to consider:

- ⛓ Lock-in period restricts liquidity

- 📉 Market volatility can reduce actual gains

- ❌ Slashing risks for validator misbehavior

- 🏦 Platform risks if you stake via exchanges

👉 Pro Tip: Use reputable platforms and diversify your staking assets.

💥 3: Can You Lose Money Staking Crypto?

Yes — here’s how:

- 📉 Price drops can outweigh rewards

- 🔐 Locked funds can’t be withdrawn in emergencies

- ⚡ Validator slashing may burn a portion of your stake

- 🕳 Platform hacks or scams can wipe funds

👉 Solution: Always research validators and consider non-custodial wallets.

🪙 4: What Are the Best Crypto Coins to Stake?

Top investor-friendly staking coins (as of 2025):

| Coin | Avg. APY | Notes |

| 🔵 Ethereum (ETH) | 3.5–4.5% | Strong network, flexible staking options |

| 🔵 Solana (SOL) | 6–7% | Fast network, no min staking |

| 🔵 Cardano (ADA) | 3–4% | Beginner-friendly, stable returns |

| 🔵 Polkadot (DOT) | 10–12% | High APY, active ecosystem |

| 🔵 Avalanche (AVAX) | 8–9% | Popular among DeFi users |

👉 Pro Tip: Start with small amounts and monitor APY variations.

🏦 5: Is Crypto Staking Better Than a Savings Account?

| Parameter | Crypto Staking | Savings Account |

| 🏦 Returns | 3% – 12% APY | 3% – 4% annual interest |

| ⚖ Risk | Moderate | Low |

| 🔒 Liquidity | Limited | Instant |

| 💹 Inflation Hedge | Yes | No |

👉 Conclusion: Staking gives better returns but is best for risk-tolerant investors.