Bitcoin is no longer just a speculative asset. With major economies now discussing strategic Bitcoin reserve proposals, the crypto asset is stepping into a new role — as a sovereign-grade store of value. For investors, this isn’t just a geopolitical shift; it’s a market signal worth watching closely.

In this article, we’ll break down what a strategic Bitcoin reserve means, why governments are considering it, how it impacts investors, and what data you should watch before making your next move.

📌 What Is a Strategic Bitcoin Reserve?

A strategic Bitcoin reserve refers to a government-owned stockpile of Bitcoin, much like how central banks hold gold or foreign currency reserves. The idea is to hedge against fiat currency devaluation, strengthen financial sovereignty, and prepare for a digitally driven global monetary future.

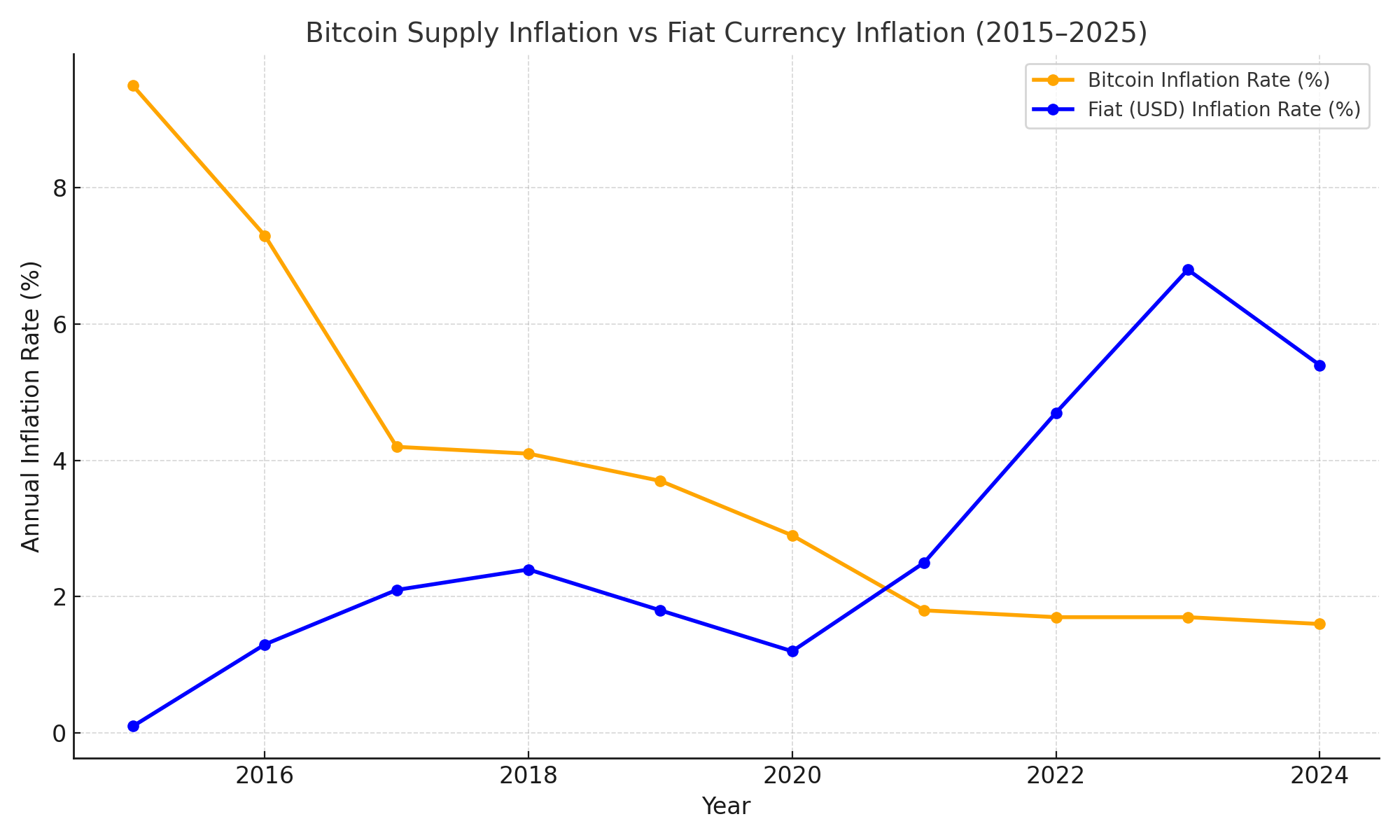

BTC Supply Curve vs. Fiat Inflation Rate

(Highlights Bitcoin’s finite 21 million cap vs. fiat money printing trends)

Why It Matters:

- Bitcoin’s supply is capped at 21 million.

- In contrast, fiat currencies continue to inflate — the USD money supply (M2) grew by over 40% between 2020–2022.

- Holding Bitcoin can insulate national reserves against dollar depreciation and inflation shocks.

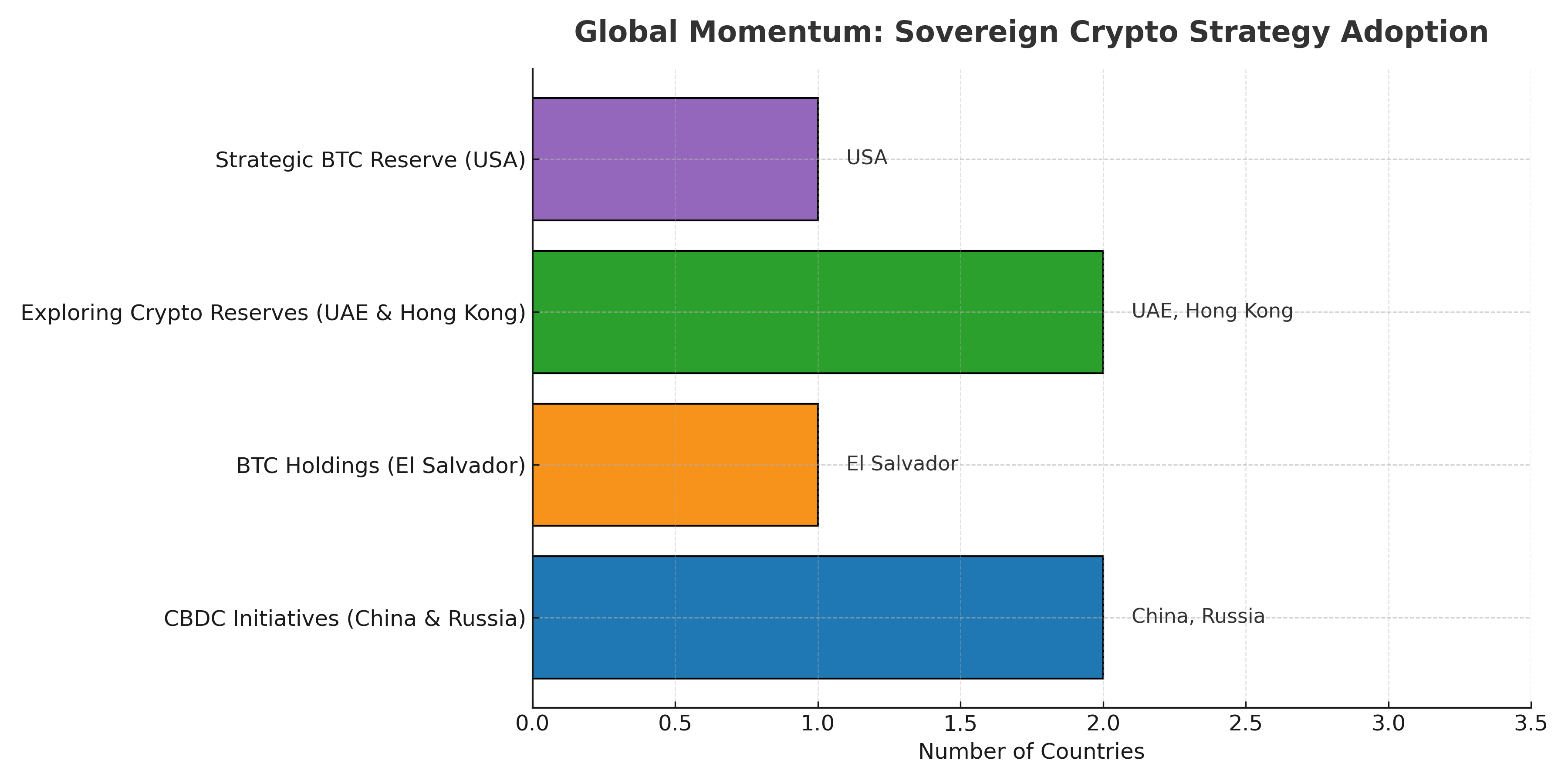

🌐 Countries Exploring Strategic Bitcoin Reserves

The trend isn’t hypothetical anymore. Global players are testing different sovereign crypto strategies.

Global Momentum – Sovereign Crypto Strategy Adoption

| Strategy | Countries |

| CBDC Initiatives | China, Russia |

| Bitcoin Holdings | El Salvador (holds ~2,800 BTC) |

| Exploring Crypto Reserves | UAE, Hong Kong |

| Strategic Bitcoin Reserve Proposal | United States (Trump’s campaign proposal)* |

*Note: Trump’s campaign has hinted at re-establishing U.S. dominance by adopting Bitcoin reserves — marking a major narrative shift.

💥 What Triggered This Momentum?

1. Geopolitical De-dollarization

Nations like China and Russia have accelerated CBDC pilots, reducing dependence on the US dollar. Simultaneously, crypto reserves are seen as a parallel safety net.

2. Bitcoin’s Resilience

Despite volatility, Bitcoin has outperformed most global assets. In the last decade:

- BTC annualized ROI: ~140%

- Gold ROI: ~1.6%

- S&P 500: ~11%

3. Institutional Legitimacy

With BlackRock, Fidelity, and global ETFs embracing Bitcoin, the asset is no longer fringe. Sovereign wealth funds and central banks are watching closely.

🧠 How Would a Strategic Reserve Work?

Step-by-step Overview:

- Legislative Proposal → Crypto policy initiation

- Reserve Framework → Procurement via central banks or strategic purchases

- Custody & Security → Cold wallets, regulated institutions

- Auditing & Reporting → Public transparency or sovereign disclosures

- Reserve Use Cases → Emergency asset, trade settlements, hedge asset

📈 Investment Implications: What Should Investors Do?

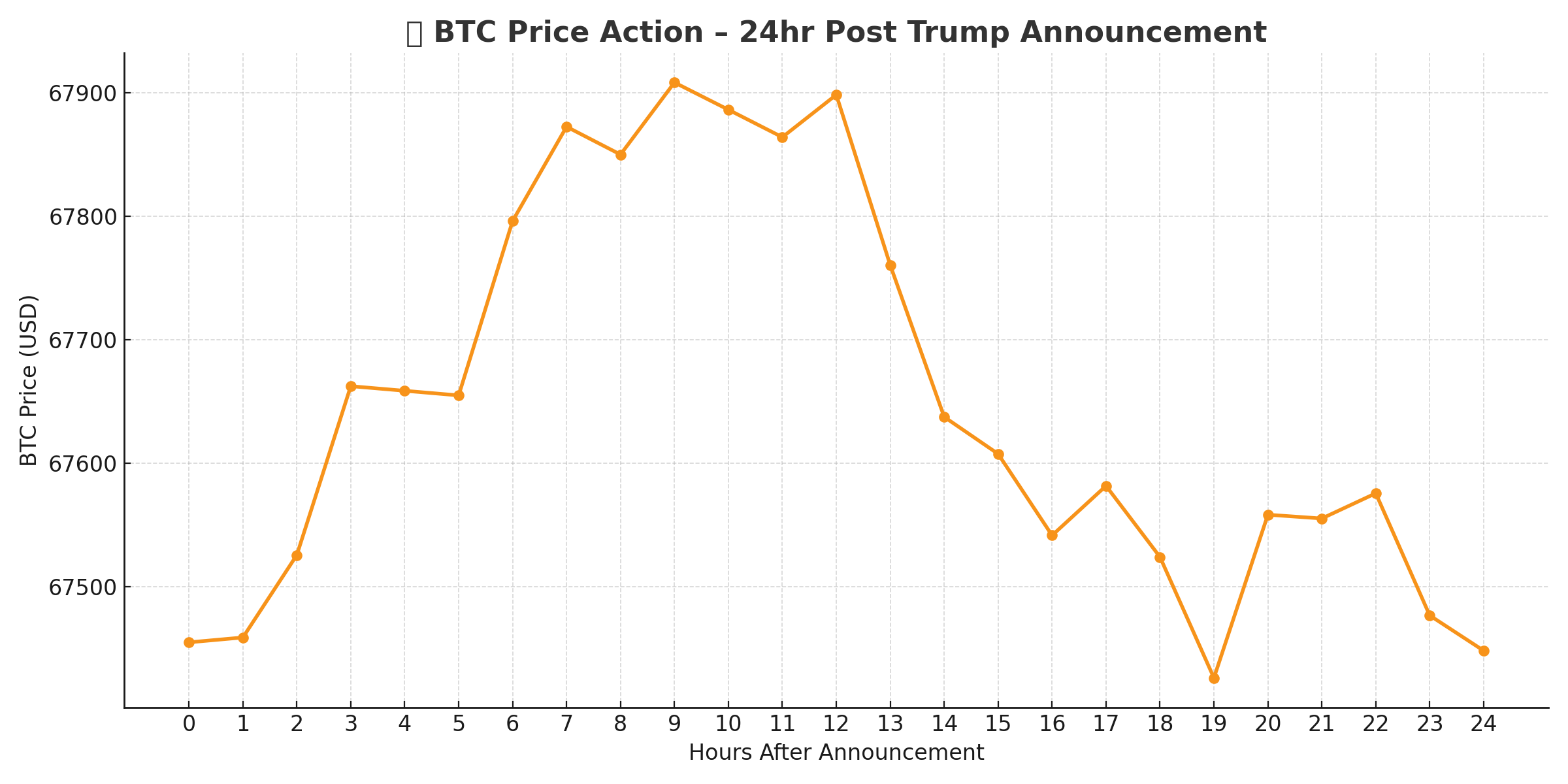

✔ 1. Track Sovereign Accumulation

Sovereign Bitcoin accumulation could reduce circulating supply — creating demand pressure and price floor.

BTC Price Action 24hr Post-Announcement (Trump’s Proposal)

(Visual cue showing immediate market reaction to geopolitical Bitcoin news)

✔ 2. Rebalance Your Portfolio

Consider diversifying your portfolio to include Bitcoin or BTC ETFs, especially if sovereign accumulation becomes a megatrend.

✔ 3. Think Long-Term Hedge

Bitcoin may become a macro hedge asset like gold. Holding a strategic allocation (5–10%) could serve as insurance against fiat shocks and currency instability.

🔎 Risk Factors to Consider

- Volatility: Bitcoin’s 30-day volatility still exceeds most asset classes.

- Regulatory Overhang: Unclear regulations may impact institutional flows.

- Custody Risks: Unlike gold, Bitcoin custody requires technical safeguards.

However, none of these risks negate the macro trend. Sovereign validation of Bitcoin adds a long-term credibility layer that individual investors can benefit from early.

Cryptocurrency Mining Environmental Impact – Click Here

📌 Final Thoughts: Be Early, Be Informed

Strategic Bitcoin reserve proposals are not just about governments — they’re a signal for institutional and retail investors alike. While policies evolve, those who position early stand to benefit most from asymmetric upside.

As the world moves from fiat dominance toward digital diversification, the smartest move may be to start treating Bitcoin not just as a speculative trade — but as a strategic asset class.

💬 Watch the policy playbook. Read the macro charts. Allocate wisely.

🧠 FAQs

❓What is a strategic Bitcoin reserve?

A government-held Bitcoin reserve used as a hedge against fiat inflation and to diversify national financial reserves.

❓Which countries are adopting Bitcoin reserves?

El Salvador has already adopted Bitcoin as legal tender. The U.S., UAE, Hong Kong, and others are exploring reserve strategies.

❓Is Bitcoin replacing gold in reserves?

Not yet fully, but many see Bitcoin as a digital alternative to gold — especially for younger economies and tech-forward nations.

❓Will strategic Bitcoin reserves impact BTC price?

Yes. Sovereign accumulation reduces supply in circulation, potentially increasing long-term value and creating new price floors.

❓Is it the right time to invest in Bitcoin?

While markets are volatile, early strategic positioning can offer high-risk-adjusted returns, especially as institutional and sovereign adoption rises.