Hello Traders, Are you worried about what will happen to XRP, the native token of the industry leader in online payments, Ripple, after the SEC vs. Ripple ruling? Most media reports indicate that Ripple is anticipated to receive a favorable decision. In that case, what impact would it have on XRPUSDT.

So, let’s examine XRPUSDT over the course of four time periods in this article: weekly, daily, four hours, and finally one hour. It will aid in comprehending both the long- and short-term perspectives.

XRPUSDT on Weekly Time Frame

The XRPUSDT coin has been experiencing a period of consolidation on weekly charts. This can be interpreted as market participants taking a wait-and-see approach, with many opting to sit on the sidelines rather than building any significant positions. This lack of movement in XRP’s price suggests that traders are eagerly anticipating news or events that could provide the much-needed directional cues.

Despite the cryptocurrency market’s inherent volatility, XRP has remained relatively stable in recent times. However, the coin is currently trading below its 20 SMA and 200 SMA key moving averages, which is indicative of a significant negative bias in the market. While this may be a cause for concern for some, it also presents an opportunity for others to enter the market at a low-risk level.

It is worth noting that Ripple’s prices have been contracting for a prolonged period. However, if the court rules in favor of Ripple against the SEC, it is highly likely that XRPUSDT prices will experience a significant surge. This presents a potentially lucrative opportunity for traders to take advantage of.

Furthermore, the XRPUSDT is currently trading close to its major support zone, making it an excellent entry point for traders looking to build positions. However, it is important to note that a quick exit strategy is necessary if the coin breaks below its support zone. Therefore, position building in small amounts at these levels would be a wise decision.

XRPUSDT on Daily Time Frame

XRPUSDT, the popular cryptocurrency Ripple, has been facing a negative medium-term bias as it continues to trade below its key moving averages. Specifically, on the Daily time frame, XRPUSDT is currently below its 20SMA and 200SMA, indicating a bearish trend that has persisted for some time.

To make matters worse, the price of Ripple has been following a traditional bearish pattern of lower lows and lower highs. This pattern reflects a pessimistic outlook for the coin, as it indicates that the sellers are in control of the market.

However, despite these negative indicators, there is a glimmer of hope for Ripple. For the past 10 months, XRPUSDT has been able to maintain its position above its immediate support range of USD 0.33-0.30. This support range has been a critical level for Ripple, and the fact that it has been able to hold this level for so long is a positive sign for the cryptocurrency.

Furthermore, with Ripple trading fairly close to its support zone, any favorable resolution of the ongoing SEC case would likely drive the prices higher. As investors gain more confidence in the regulatory status of Ripple, they are likely to start buying the coin, which would result in a surge in its price.

XRPUSDT on 4 Hour Time Frame

The current market trend of XRPUSDT indicates a negative bias as it is trading below its 20 SMA and 200 SMA with a lower high-low pattern on the 4-hour time frame. This suggests that traders should approach the market with caution.

On 23rd of March, XRPUSDT experienced a sudden drop in prices due to pressure on the entire crypto market. However, the asset has slowly managed to recover most of its losses. Despite this recovery, XRPUSDT is still trading within the trading range of a big bearish candle, indicating that the asset may continue to face selling pressure.

Therefore, before creating any position in XRPUSDT, it is crucial to wait for a sustained close above its 200SMA on the 4-hour time frame. This would suggest a potential shift in the current market trend and provide more clarity for traders to make informed decisions.

Adani Enterprise (ADANIENT) in Tradingview – Full Analysis- Click Here

Pundit Speaks

In conclusion, while XRPUSDT may not be showing any significant movements at present, it is a coin that is definitely worth keeping an eye on. With potential positive news on the horizon, coupled with its current low-risk entry level, now could be the perfect time to consider building a position in XRPUSDT. However, as with any investment, it is important to exercise caution and have a clear exit strategy in place.

Other Factors

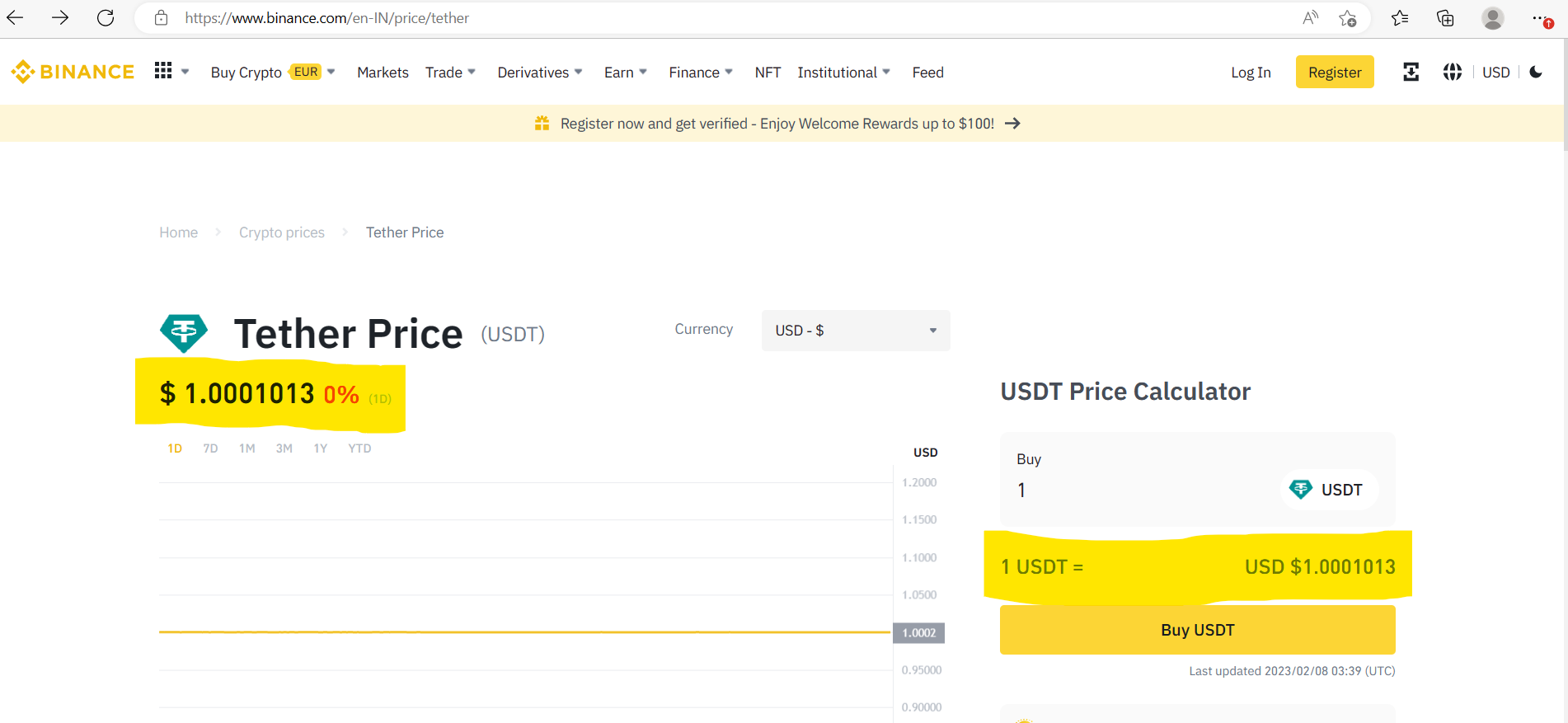

1)US dollar to USDT pegging

The value of USDT will always be derived from the US dollar because it is a stablecoin. Simply put, 1 USDT will always be equivalent to 1 USD, ceteris paribus. But occasionally, the USDT loses its peg to the US dollar. like it happened in the FTX exchange scam.

The short-term XRPUSDT prices may also be impacted by such circumstances. But over the long term, USDT always adheres to the peg.

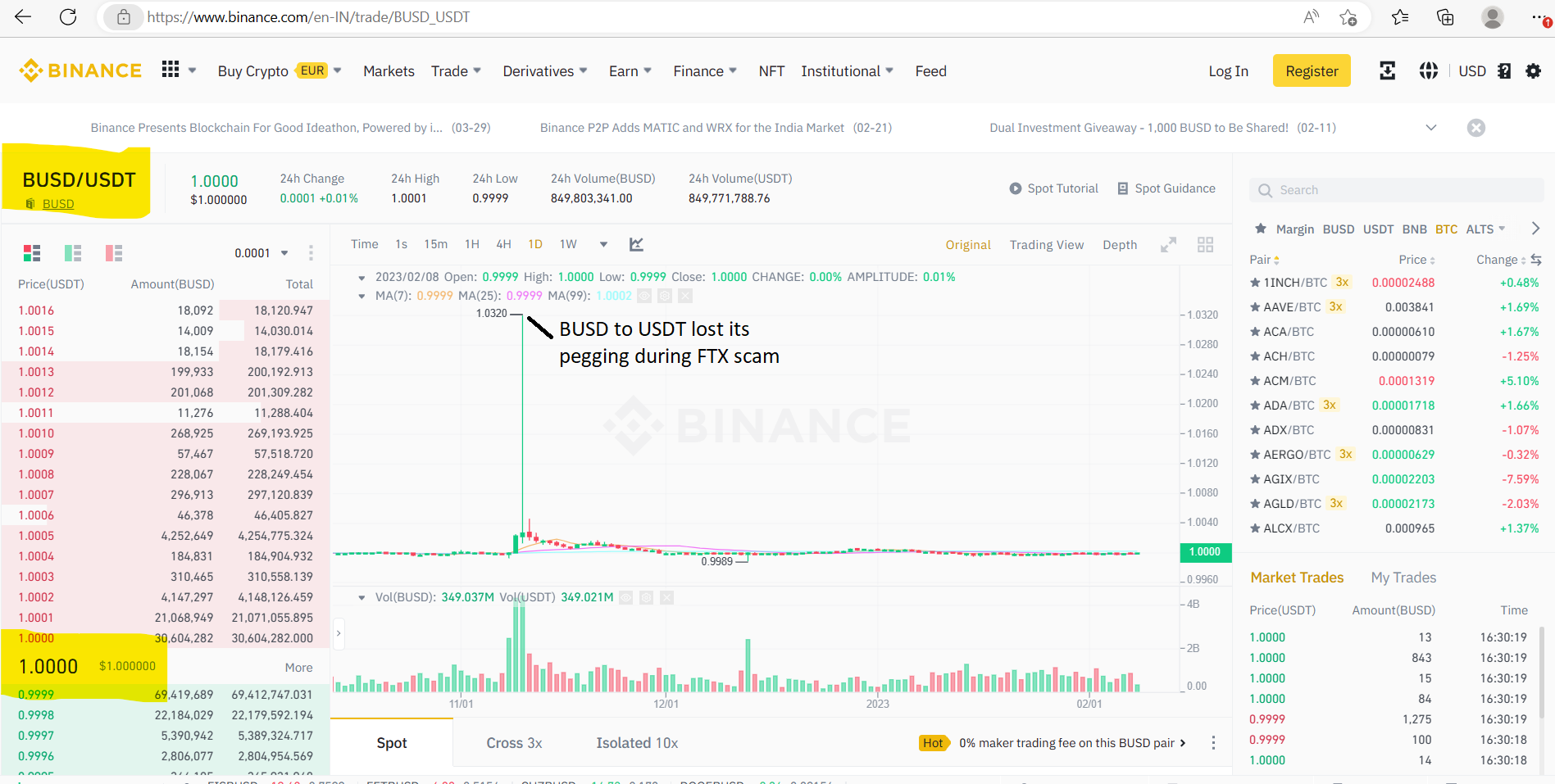

2)BUSD to USDT Pegging

Another well-known stablecoin is BUSD, which is issued by Paxos and one of the biggest cryptocurrency exchanges, Binance. A 1:1 reserve of US dollars held by Binance is used to back BUSD.

Before making an investment in the XRPUSDT pair, it is crucial to pay close attention to the BUSD to USDT pegging. If the pegging value is greater than 1, then traders favor the BUSD over the USDT, and vice versa.

Traders will then start buying the BUSD pair and selling the MATICUSDT pair.

Disclaimer :

CryptoPunditz.com is not a registered investment, legal, or tax advisor or a broker/dealer. All investment/financial opinions expressed by CryptoPunditz.com are from the personal research and experience of the owner of the site and are intended as educational material. Although best efforts are made to ensure that all information is accurate and up to date, occasionally unintended errors and misprints may occur.