In the Indian stock market, the trading activities of Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) often exhibit contrasting patterns. Understanding these differences is crucial for investors aiming to navigate the National Stock Exchange (NSE) effectively. This article delves into the factors contributing to the divergent trading behaviors of FIIs and DIIs, supported by recent data and trends.

Investment Horizons and Strategies

FIIs

Foreign investors typically adopt short- to medium-term investment strategies. Their decisions are heavily influenced by global economic indicators, geopolitical events, and currency fluctuations. For instance, in January 2025, FIIs sold approximately $9 billion worth of Indian equities, largely due to rising U.S. Treasury yields and a stronger dollar.

DIIs

In contrast, domestic investors, including mutual funds, insurance companies, and banks, often have a long-term investment perspective. Their strategies are primarily driven by domestic economic policies, corporate earnings, and market valuations. During periods of FII outflows, DIIs frequently act as stabilizing forces by purchasing equities, thereby mitigating market volatility.

Risk Perception and Market Sentiment

Global vs. Domestic Risks

FIIs are sensitive to international risks such as changes in global trade policies, geopolitical tensions, and shifts in commodity prices. For example, in November 2024, foreign outflows from Indian markets moderated as FIIs turned buyers in financial and IT sectors, influenced by a strong U.S. economy and potential corporate tax reforms.

DIIs, however, focus more on domestic factors like national economic reforms, fiscal policies, and local political developments. Their familiarity with the local market enables them to better assess and manage domestic risks, often leading them to capitalize on opportunities that foreign investors might overlook.

How U.S. Interest Rates, Economic Data, and China’s Market Trends Shape Indian Investments

As of February 2025, the Federal Open Market Committee (FOMC) has maintained the federal funds rate at 4.25% to 4.50%. Philadelphia Fed President Patrick Harker supports this stance, emphasizing its role in steering inflation toward the 2% target without undermining labor market strength.

Key U.S. Economic Indicators:

-

Nonfarm Payrolls: December 2024 saw an addition of 256,000 jobs, culminating in 2.2 million jobs for the year, averaging 186,000 monthly—a decline from the 3 million jobs added in 2023.

-

Inflation: The Personal Consumption Expenditures (PCE) price index rose by 0.3% in January 2025, with a year-over-year increase of 2.5%. Despite this moderation, elevated costs in housing and groceries persist.

Impact of U.S. High Interest Rates on India:

-

Capital Flows: Elevated U.S. rates attract investors to American assets, potentially leading to capital outflows from emerging markets like India. This shift can exert pressure on the Indian rupee and elevate yields on government securities.

-

Currency Valuation: A stronger U.S. dollar, bolstered by higher interest rates, can result in a depreciating rupee, making imports costlier and widening the trade deficit.

China’s Market Dynamics and Implications for India:

-

Economic Slowdown: China’s decelerating growth, influenced by policy shifts and global trade tensions, has prompted investors to reassess exposure, leading to capital reallocation.

-

Investment Diversion: As investors seek alternatives, India emerges as a viable destination due to its market potential and reform initiatives. This shift could bolster foreign direct investment and strengthen India’s manufacturing sector.

Investor Recommendations:

-

Diversify Portfolios: Allocate investments across sectors and geographies to mitigate risks associated with global economic fluctuations.

-

Monitor Economic Indicators: Stay informed on U.S. monetary policy, employment data, and inflation trends, as these factors influence global capital movements.

-

Assess Currency Exposure: Consider the potential impacts of currency volatility on investments, especially for portfolios with significant foreign holdings.

By integrating these strategies, investors can navigate the complexities of the current economic landscape and make informed decisions aligned with their financial objectives.

Regulatory and Taxation Policies

Influence of Policy Changes

FIIs are highly responsive to changes in international taxation laws, trade agreements, and foreign investment regulations. For instance, in August 2024, foreign investors shifted focus from India’s secondary markets to primary markets via initial public offerings (IPOs), seeking better valuations amidst high secondary market prices

DIIs, on the other hand, are more influenced by domestic regulatory changes, such as amendments in tax policies, investment guidelines, and sector-specific reforms. Their deep understanding of the local regulatory environment enables them to adapt swiftly and align their investment strategies accordingly.

Data-Driven Insights

Analyzing trading data provides concrete evidence of the contrasting behaviors between FIIs and DIIs.

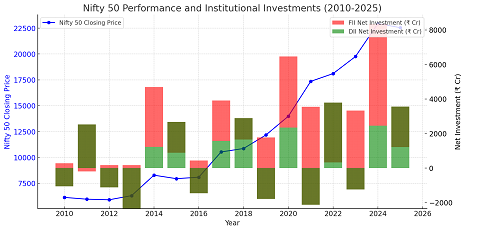

Here’s an analysis based on the Nifty 50 performance and institutional investments (FII & DII) from 2010 to 2025, as seen in the chart:

Key Observations from the Chart (Yearly Breakdown)

- 2010:

- Nifty 50 closed at 6,134.50, showing a positive trend.

- FIIs had net inflows of ₹1,333 Cr, indicating foreign confidence in the Indian markets.

- DIIs, however, recorded outflows of ₹1,057 Cr, possibly due to profit-booking.

- 2011:

- Nifty declined slightly to 5,962.20, showing market consolidation.

- FIIs withdrew ₹2,714 Cr, possibly due to global economic uncertainties (Eurozone crisis).

- DIIs stepped in with ₹2,523 Cr of buying, stabilizing the market.

- 2012:

- Market remained range-bound at 5,905.10.

- FIIs returned with ₹1,279 Cr of inflows, showing renewed confidence.

- DIIs still remained net sellers (₹1,112 Cr outflow).

- 2013:

- Nifty moved up to 6,304.00, fueled by positive FII sentiment.

- FIIs invested ₹2,513 Cr, leading the market upwards.

- DIIs, however, pulled out ₹2,345 Cr, possibly due to policy uncertainties ahead of elections.

- 2014 (Modi Govt Wins Elections):

- Nifty jumped to 8,282.70, as FIIs poured in ₹3,456 Cr, betting on economic reforms.

- DIIs also turned net buyers at ₹1,234 Cr, supporting the market rally.

- 2015:

- Nifty corrected to 7,946.35 due to global market concerns and profit-booking.

- FIIs pulled out ₹1,789 Cr, reacting to global volatility.

- DIIs, however, supported the market with ₹2,678 Cr of buying.

- 2016 (Demonetization Impact):

- Nifty recovered slightly to 8,086.80 after initial shocks.

- FIIs invested ₹1,890 Cr, despite demonetization fears.

- DIIs sold ₹1,456 Cr, possibly due to concerns over cash liquidity in the economy.

- 2017 (Bull Market Rally):

- Nifty soared to 10,530.70, fueled by strong earnings and liquidity.

- FIIs invested ₹2,345 Cr, continuing the rally.

- DIIs also supported with ₹1,567 Cr inflows, indicating strong domestic confidence.

- 2018:

- Nifty at 10,862.55, consolidating after a strong 2017 rally.

- FIIs turned net sellers at ₹1,234 Cr, possibly due to global trade war concerns.

- DIIs stepped in with ₹2,890 Cr of buying, balancing the impact.

- 2019 (Pre-COVID Rally):

- Nifty moved up to 12,168.45, amid strong corporate earnings.

- FIIs invested ₹3,567 Cr, showing foreign interest in Indian equities.

- DIIs, however, booked profits (₹1,789 Cr outflows).

- 2020 (COVID-19 Crash & Recovery):

- Nifty initially fell but closed at 13,981.75, recovering towards year-end.

- FIIs invested ₹4,123 Cr, betting on India’s long-term growth.

- DIIs also supported with ₹2,345 Cr of buying.

- 2021 (Post-Pandemic Rally):

- Nifty surged to 17,354.05, driven by economic recovery.

- FIIs invested ₹5,678 Cr, pushing the rally further.

- DIIs, however, booked profits with ₹2,123 Cr of outflows.

- 2022 (FII Outflows & Market Volatility):

- Nifty stabilized at 18,105.30, despite global recession fears.

- FIIs pulled out ₹3,456 Cr, reacting to interest rate hikes.

- DIIs countered the selling with ₹3,789 Cr of buying, cushioning the fall.

- 2023:

- Nifty rose to 19,756.85, supported by local investor participation.

- FIIs invested ₹4,567 Cr, showing renewed confidence.

- DIIs booked profits (₹1,234 Cr outflows).

- 2024:

- Nifty hit a new high at 22,945.30, reflecting strong economic growth.

- FIIs invested ₹5,890 Cr, continuing the bullish trend.

- DIIs also supported with ₹2,456 Cr of buying.

- 2025 (Current Year):

- Nifty slightly corrected to 22,547.55, possibly due to profit-booking.

- FIIs turned net sellers at ₹2,345 Cr, leading to some volatility.

- DIIs, however, stepped in with ₹3,567 Cr of inflows, stabilizing the market.

Key Takeaways from the Analysis:

- FII movements strongly impact the Nifty 50’s direction.

- Large inflows (2014, 2017, 2020, 2021) correspond to market rallies.

- Outflows (2011, 2015, 2018, 2022) often lead to corrections.

- DIIs act as a stabilizing force, countering FII outflows.

- When FIIs exit (2011, 2015, 2018, 2022, 2025), DIIs often increase buying.

- This prevents drastic market crashes.

- Major events influence FII/DII behavior:

- 2014: Election rally → FIIs turned heavy buyers.

- 2016: Demonetization → FIIs stayed positive, DIIs cautious.

- 2020: COVID crash & recovery → FIIs and DIIs both invested.

- 2022: Global interest rate hikes → FIIs withdrew, DIIs absorbed the shock.

- Currently (2025), DIIs are driving the market more than FIIs.

- FII outflows show caution, possibly due to global risks.

- DIIs remain strong, reflecting domestic confidence.

Crypto Arbitrage Trading in India – Click Here

Conclusion

Historically, Foreign Institutional Investors (FIIs) have been the primary drivers of bull markets in India, injecting significant liquidity and fueling market rallies. However, Domestic Institutional Investors (DIIs) play a crucial stabilizing role, cushioning sharp declines by absorbing sell-offs during periods of FII outflows. In recent years, DIIs have emerged as a stronger force, providing consistent support to the Nifty 50, even when FIIs exhibit cautious behavior due to global uncertainties. Given their influence on market trends, investors should closely monitor FII and DII investment patterns, as they serve as early indicators of potential market movements and sentiment shifts.

FAQs

- What are the primary differences between FIIs and DIIs?

FIIs are foreign entities investing in Indian markets, often with a short- to medium-term outlook, while DIIs are domestic institutions with a long-term investment perspective. - How do currency fluctuations impact FII investments?

A depreciating Indian Rupee can reduce returns for FIIs, leading to potential outflows from the market. - Why do DIIs often buy when FIIs sell?

DIIs may view market downturns, prompted by FII sell-offs, as buying opportunities based on their long-term investment strategies. - What factors influence FII trading decisions?

Global economic indicators, geopolitical events, and currency movements are primary factors influencing FII decisions. - How can investors use FII and DII data to inform their strategies?

By analyzing FII and DII trading patterns, investors can gauge market sentiment and identify potential investment opportunities or risks.

Sources: