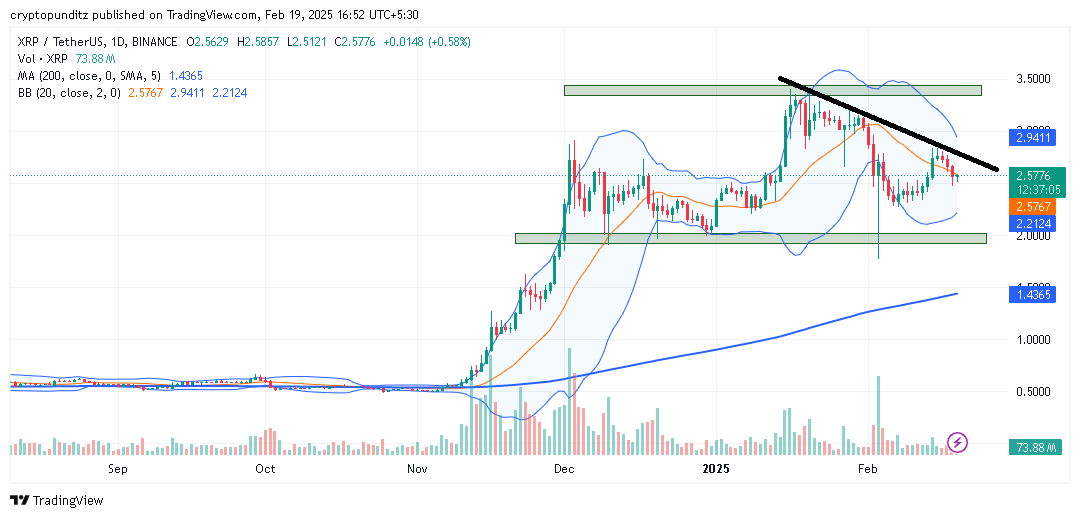

In February 2025, XRP experienced a notable 19% decline, falling from $3.17 at the start of the month to $2.56 by February 19. This downturn can be attributed to a combination of macroeconomic factors, regulatory uncertainties, and market dynamics.

Macroeconomic Factors and Global Trade Tensions

The global economic landscape in early 2025 has been marked by heightened trade tensions, particularly between the United States and China. In late January, President Donald Trump announced substantial tariffs on imports from China, leading to retaliatory measures from the Chinese government. These escalating trade disputes have introduced significant volatility into global financial markets, including the cryptocurrency sector. As investors grapple with uncertainty, many have shifted away from riskier assets like cryptocurrencies, contributing to the decline in XRP’s value.

Regulatory Uncertainties and Market Sentiment

The regulatory environment surrounding cryptocurrencies remains a critical factor influencing investor confidence. In early February 2025, the U.S. Securities and Exchange Commission (SEC) postponed its decision on approving several cryptocurrency exchange-traded funds (ETFs), including those related to XRP. This delay has fueled uncertainty among investors, leading to cautious trading behaviors and a subsequent decrease in demand. The anticipation of potential regulatory actions or restrictions has historically led to market sell-offs, as seen in XRP’s recent performance.

Market Dynamics and Investor Behavior

Market dynamics, including profit-taking and shifts in investor sentiment, have also played a role in XRP’s price decline. After reaching an all-time high of $3.41 in mid-January 2025, XRP’s overvaluation prompted some investors to secure profits, leading to increased selling pressure. This behavior is common in volatile markets, where rapid price appreciations are often followed by corrections. Additionally, the broader cryptocurrency market has experienced a downturn, with major assets like Bitcoin and Ethereum also facing declines, which can influence the performance of altcoins like XRP.

Technical Indicators and Support Levels

Technical analysis of XRP’s price movements indicates critical support and resistance levels that traders monitor. As of February 19, 2025, XRP is trading near a support level of $2.33. A breach below this threshold could signal further declines, potentially targeting the $1.94 range. Conversely, if XRP manages to hold above this support and gains upward momentum, it may retest resistance levels around $2.70. Traders and investors closely watch these levels to inform their buying or selling decisions.

Broader Economic Indicators

Inflation rates and monetary policies significantly impact investment strategies across various asset classes, including cryptocurrencies. In February 2025, the U.S. Federal Reserve indicated a cautious approach toward adjusting interest rates, aiming to balance inflation control with economic growth. This stance affects investor appetite for high-risk assets, as higher interest rates can lead to reduced liquidity in financial markets. Consequently, assets like XRP may experience decreased demand during periods of monetary tightening.

Memeinator: The Crypto Revolution: A Comprehensive Guide – Click Here

Conclusion

The 19% decline in XRP’s value in February 2025 is the result of a confluence of factors, including global trade tensions, regulatory uncertainties, market dynamics, and broader economic indicators. Investors should remain vigilant, considering both macroeconomic developments and technical analyses when making investment decisions related to XRP and the broader cryptocurrency market.