Hello Traders, Are you concerned that tweets from Elon Musk might affect the price of DogeCoin or other meme coins, such as Shiba INU and FLOKI? To answer this question, we will need to analyze the DOGEUSDT Tradingview in various time frames, which will help us understand the coin’s overall supply and demand dynamics.

This article will analyze the DOGEUSDT over the course of four time frames: weekly, daily, four hours, and finally one hour. It will help us understand the long-term view and the short-term view.

DOGEUSDT on the Weekly Time Frame

On the weekly time frame, the DOGEUSDT seems to be moving in a sideways consolidation. Therefore, the major trend of the coin would be sideways.

While this is going on, DOGEUSDT is also finishing up a formation of GBR (Green Bar Reversal), which Oliver Velez uses frequently in its numerous seminars. The GBR formation highlights the tussle between bulls and bears.

This pattern clearly shows that despite two attempts by sellers to book profits, buyers are holding onto the positions they created around the breakout zone.

At the same time, since the coin is trading close to its key support range of USD 0.06-0.04, this profit booking gave us the chance to establish a new long position in the DOGEUSDT.

At these levels, we have very low-risk entry opportunities.

The RSI, or relative strength index, is also moving in a higher high-low formation and has surpassed the 50-level threshold, indicating that bulls are currently present in the coin.

Polygon Matic in Tradingview (Updated)- Multiple time frame Analysis- Click Here

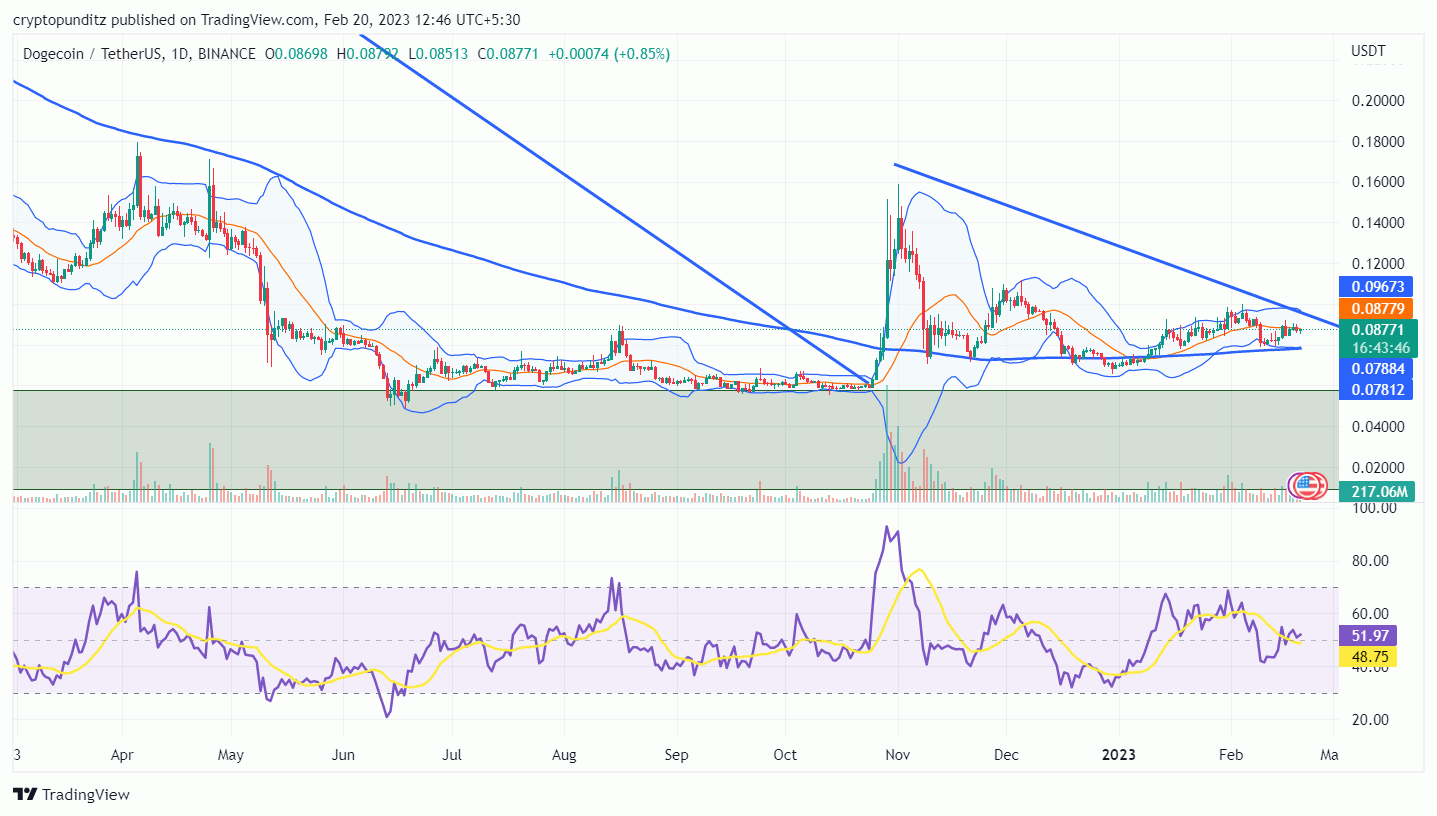

DOGEUSDT on the Daily Time Frame

On the daily time frame, too, DOGEUSDT is consolidating. The GBR candlestick formation on the weekly time frame is actually forming a descending triangle formation on the daily time frame.

A descending triangle formation highlights the tussle between bulls and bears. Or, more specifically, the bulls are trying to absorb all the selling pressure generated by the bears and waiting for the right time to break out of the consolidation phase.

Higher volumes along with a strong breakout would undoubtedly indicate a buildup of positive sentiment. However, investors are advised to watch for a sustained closing above the breakout zone.

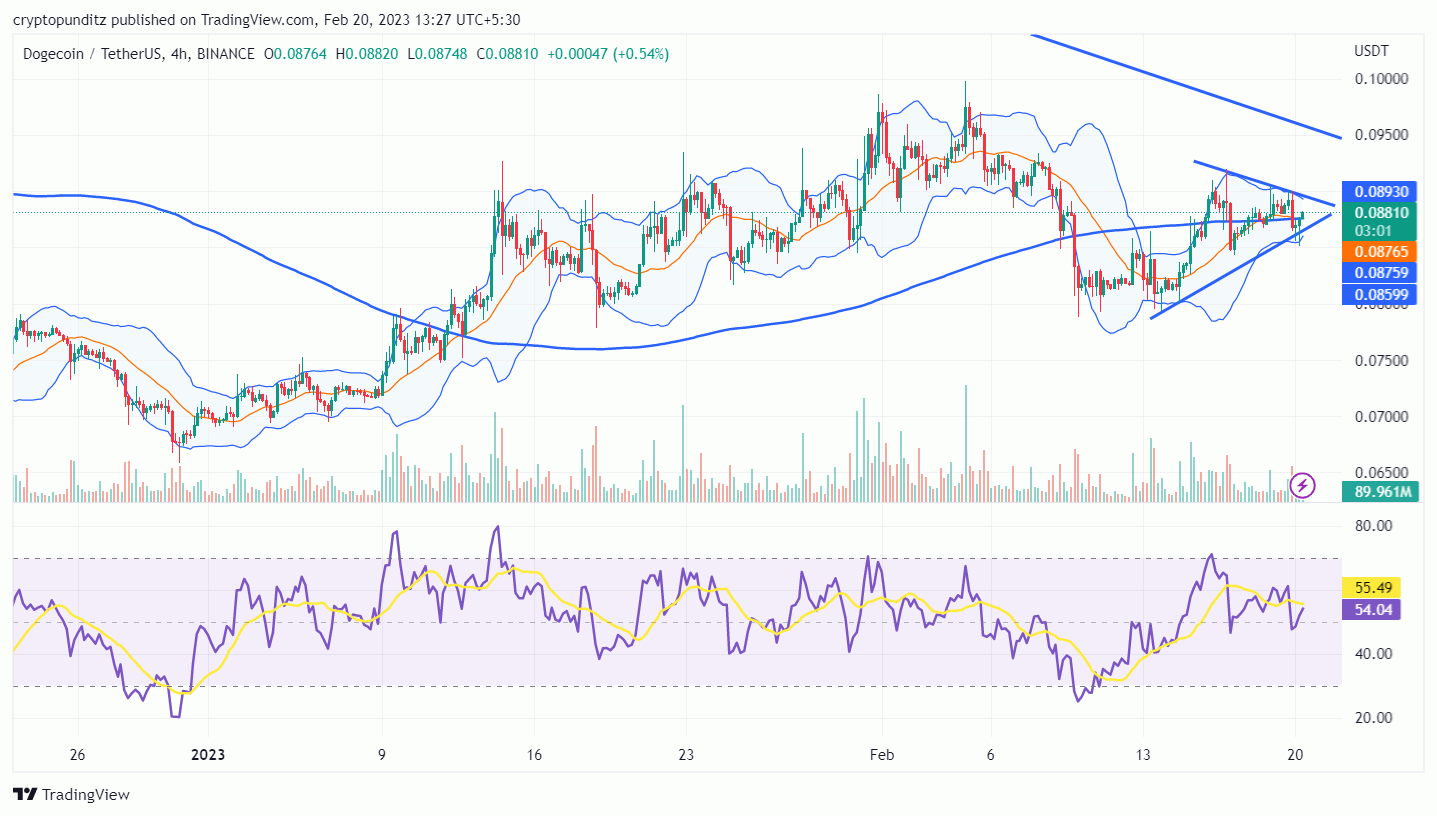

DOGEUSDT on a 4 Hour Time Frame

On 4-hour time frame, price action suggests that the DOGEUSDT is in sideways consolidation. The 200 SMA and 20SMA, two important moving averages in this lower time frame, are extremely close to one another, showing that both long-term investors and short-term traders believe there is no trend in the DOGEUSDT.

Therefore, it is recommended for short-term traders to hold off on opening any positions in this coin until the breakout, which could be positive or negative.

Long-term investors, on the other hand, use this consolidation to stockpile coins at the current prices.

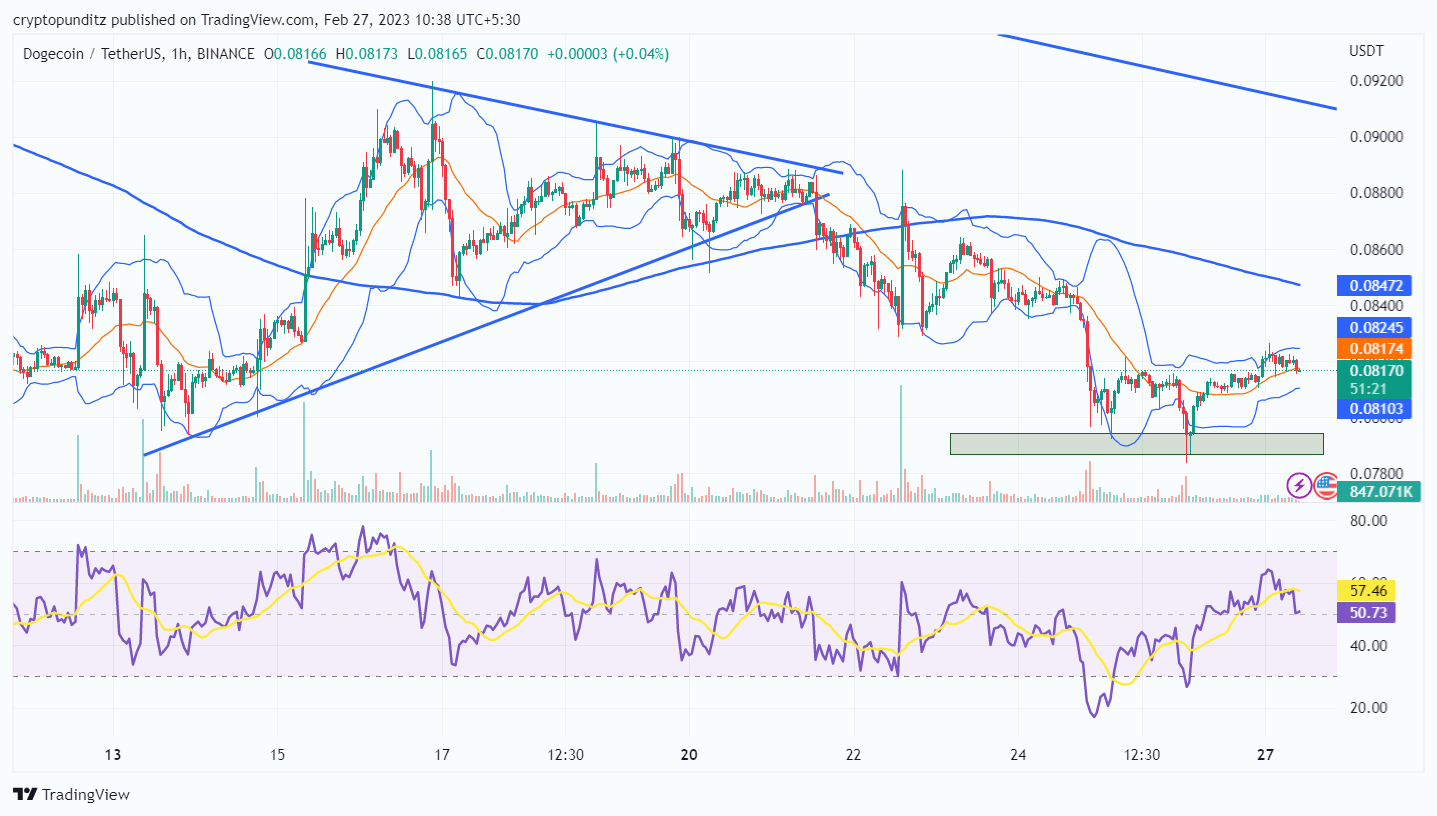

DOGEUSDT on a 1 Hour Time Frame

On a 1 Hour time frame, DOGEUSDT exhibited a negative breakout from the triangle pattern that we mentioned on 4 Hour chart.

In addition, the coin is trading below its 200- and 20-day simple moving averages, showing a short-term bias that is negative.

As a result, using every rise to open a short position is the best course of action for playing the Dogecoin in the short term, as price action indicates a short-term bias that is unfavorable.

However, the coin’s price action also shows that it had established a temporary base between USD 0.79 and 0.77. If it is able to maintain itself above the support zone, some short covering may occur.

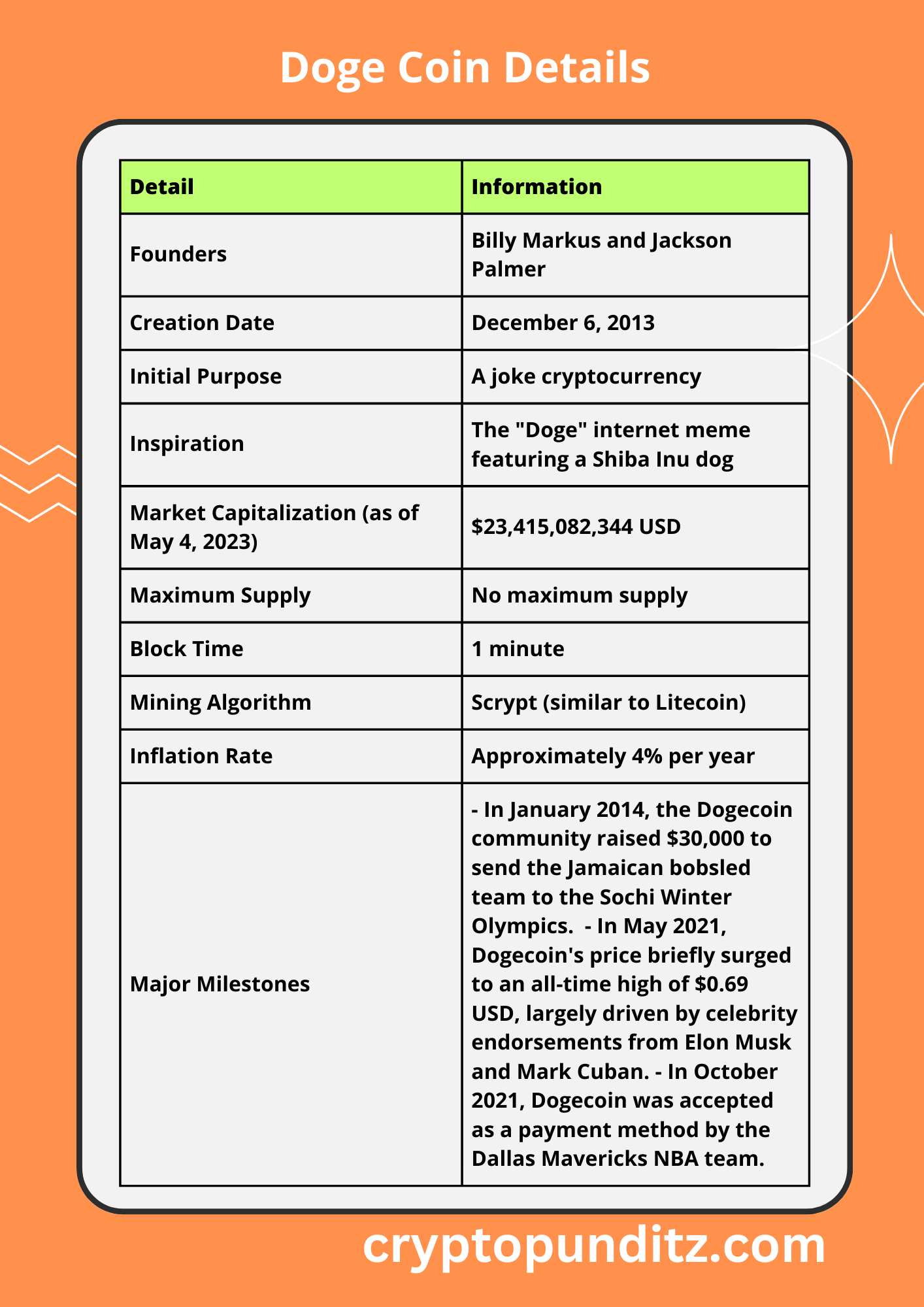

DogeCoin Details

Okay, so up until this point, we had only examined one component of this pair—DogeCoin. Let’s now take a look at other factors that may have an impact on the price of this pair even though dogecoin prices are unchanged.

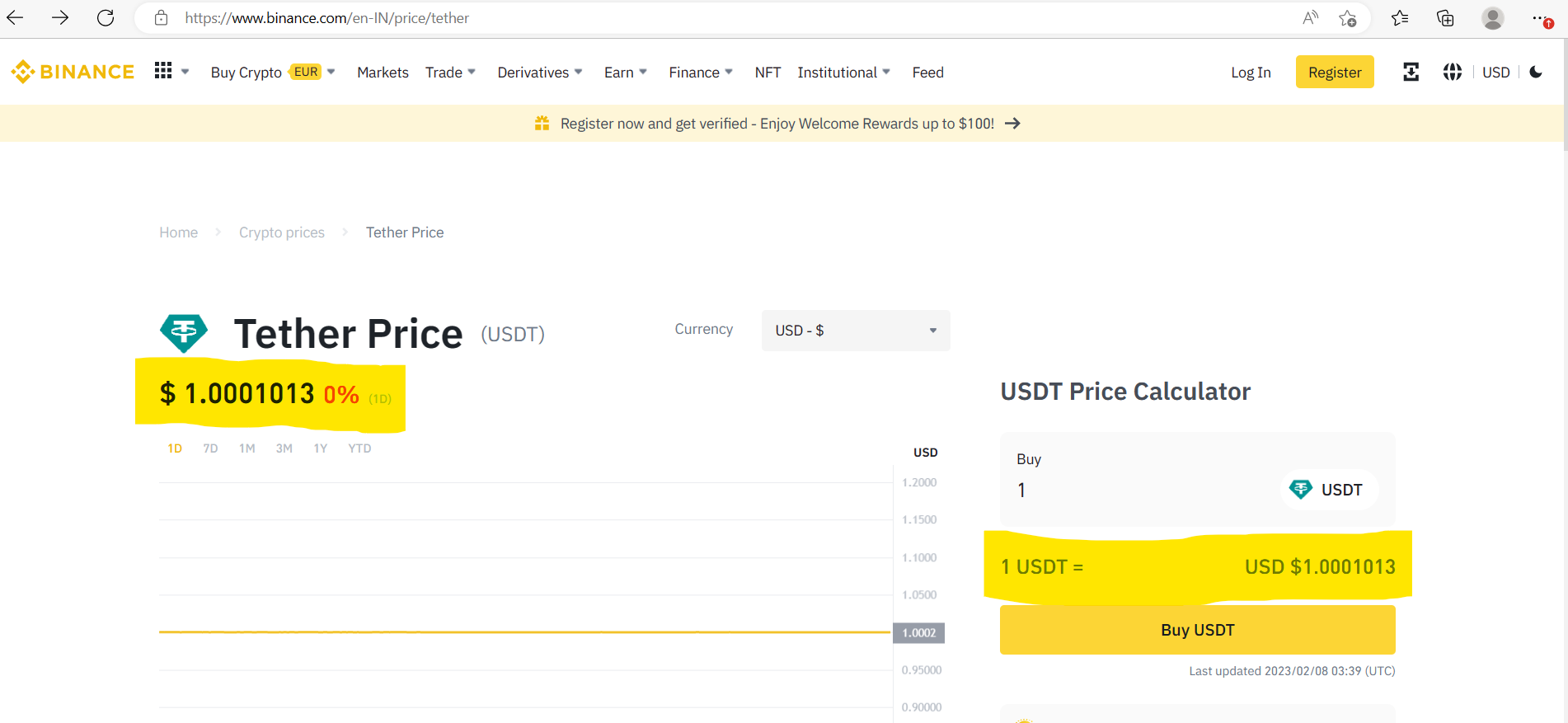

US dollar to USDT peg

The value of USDT will always be derived from the US dollar because it is a stablecoin. Simply put, 1 USDT will always be equivalent to 1 USD, ceteris paribus. But occasionally, the USDT loses its peg to the US dollar. like it happened in the FTX exchange scam.

The short-term DOGEUSDT prices may also be impacted by such circumstances. But over the long term, USDT always adheres to the peg.

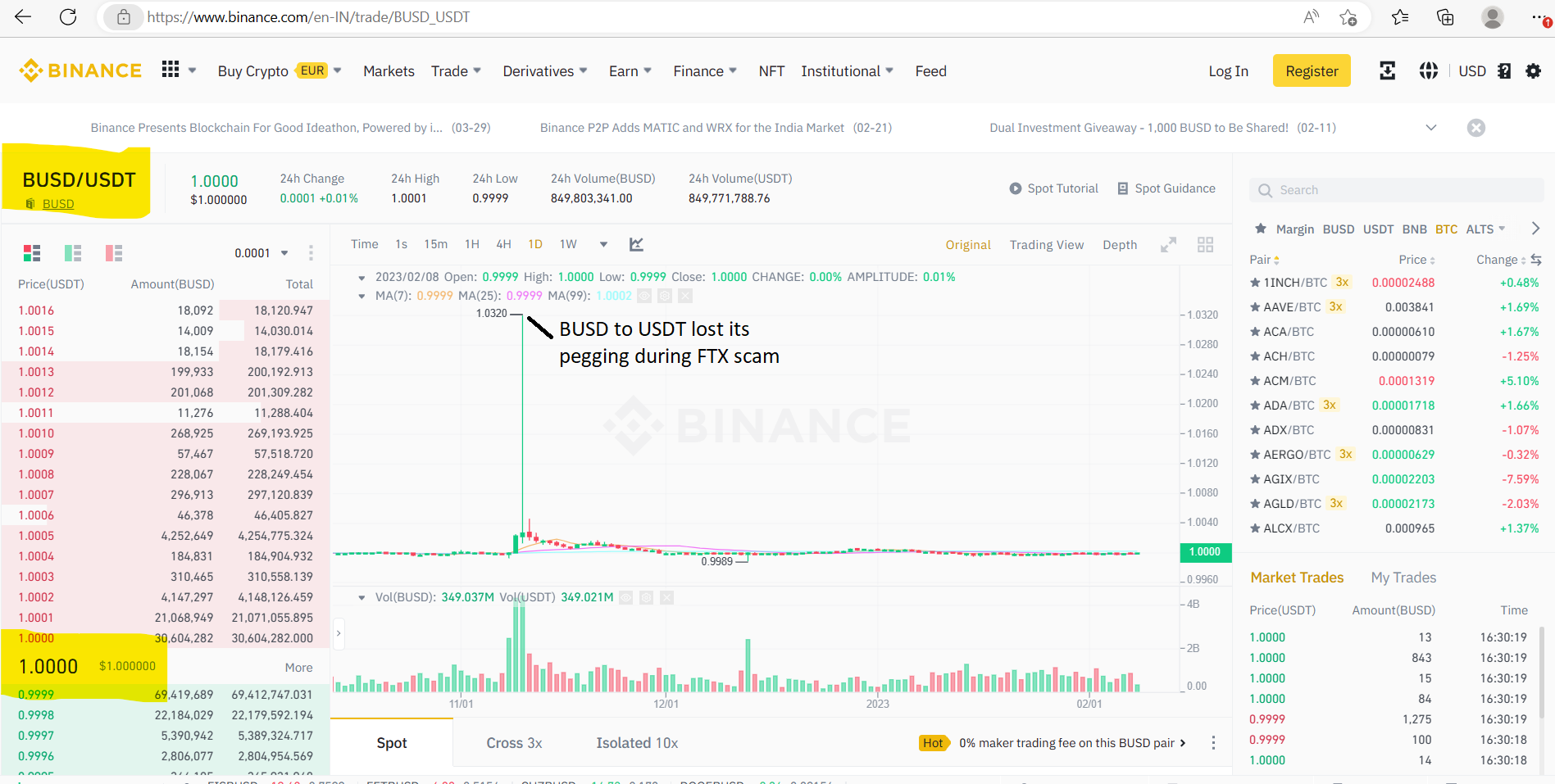

BUSD to USDT Peg

Another well-known stablecoin is BUSD, which is issued by Paxos and one of the biggest cryptocurrency exchanges, Binance. A 1:1 reserve of US dollars held by Binance is used to back BUSD.

Before making an investment in the DOGEUSDT pair, it is crucial to pay close attention to the BUSD to USDT pegging. If the pegging value is greater than 1, then traders favor the BUSD over the USDT, and vice versa.

Traders will then start buying the BUSD pair and selling the DOGEUSDT pair.

How to invest in cryptocurrency in India? – Click Here

Elon Musk Tweets

This recent tweets by Elon Musk created buzz around the meme coins