Investors often face the dilemma of choosing between cryptocurrencies and Indian equities. While cryptocurrencies promise high returns and global accessibility, Indian stocks offer stability and long-term wealth creation. Understanding their performance, risk factors, and suitability is crucial for investors of different experience levels.

This article presents an in-depth comparative analysis of historical returns, volatility, and investment suitability, backed by official data and visual representations.

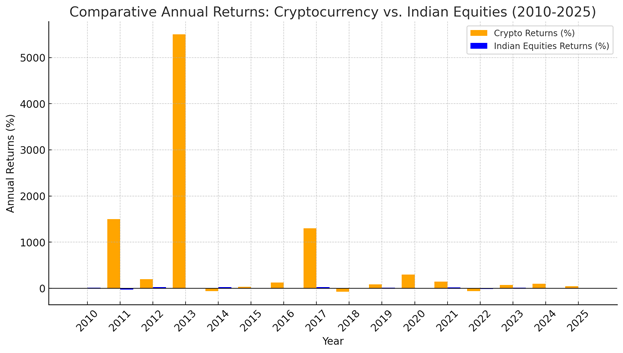

1. Historical Performance: Cryptocurrency vs. Indian Equities

1.1 Performance of Indian Equities

The NIFTY 50 index, India’s benchmark stock index, has delivered a Compound Annual Growth Rate (CAGR) of approximately 11.3% over the past three decades (1995-2025). Notable annual returns include:

- 2020: +14.9% (Post-COVID rally)

- 2021: +24.1% (Bull run)

- 2022: +4.3% (Global slowdown impact)

- 2023: +20.5% (Strong economic recovery)

- 2024: +10.8% (Steady growth)

1.2 Performance of Major Cryptocurrencies

- Bitcoin (BTC): As of 24, February 2025, Bitcoin is trading at $95,718, reflecting significant growth since its inception. Notable annual returns include:

- 2020: +302%

- 2021: +59%

- 2022: -64% (Market correction)

- 2023: +155% (Recovery phase)

- 2024: +40% (Moderate growth)

Cryptocurrencies, particularly Bitcoin, have consistently outperformed traditional asset classes in terms of absolute returns. Since its inception, Bitcoin has delivered astronomical growth, with notable surges such as 305% in 2020 and 1300% in 2017. In contrast, Indian equities, represented by the NIFTY 50 index, have maintained an average annual return of ~12% over the past two decades.

However, higher returns come with significantly higher volatility. Unlike equities, where price movements are influenced by corporate earnings, macroeconomic factors, and government policies, cryptocurrencies are driven by

2. Volatility & Risk: Which Market is More Stable?

2.1 Volatility in Indian Equities

Indian equities exhibit moderate volatility with occasional market corrections:

- Standard Deviation of NIFTY 50 (last 10 years): ~17%

- Major Corrections:

- 2020 COVID-19 Pandemic: -39% (Sharp decline followed by recovery)

The market typically recovers within 3-5 years, making it a safer bet for long-term investors.

2.2 Volatility in Cryptocurrency

Cryptocurrency markets experience higher volatility due to factors like speculation and regulatory developments:

- Bitcoin’s Standard Deviation: ~80% (Last 10 years)

- Significant Fluctuations:

- 2022: -64% (Market correction)

- 2023: +155% (Recovery phase)

Indian equities offer more stability, while cryptocurrencies present higher risk and potential for higher returns.

3. Suitability: Beginners vs. Experts

3.1 Which is Better for Beginners?

- Indian Equities: Recommended for beginners due to regulation, historical performance, and predictable growth. Instruments like Index Funds and Blue-chip Stocks provide steady returns with lower risk.

3.2 Which is Preferred by Experts?

- Cryptocurrencies: Experts with a high-risk appetite may prefer cryptocurrencies for potential exponential gains. Active monitoring and a deep understanding of market dynamics are essential.

Beginners should prioritize Indian equities, while experienced investors might explore cryptocurrencies, considering their risk tolerance.

4. Ideal Investment Mix Based on Risk Appetite

| Risk Profile | Equity Allocation | Crypto Allocation |

| Conservative (Low risk) | 90% | 10% |

| Moderate (Balanced risk) | 70% | 30% |

| Aggressive (High risk) | 50% | 50% |

Both Indian equities and cryptocurrencies offer unique advantages. Equities provide long-term stability and steady returns, making them ideal for wealth creation. Cryptocurrencies, though volatile, present high-growth potential for risk-tolerant investors. The ideal investment approach is a balanced mix, tailored to individual risk tolerance, financial goals, and market conditions. Beginners should start with equities, while experienced investors can explore a diversified mix of both. A strategic, well-diversified portfolio is key to maximizing returns while managing risk effectively.

5. Regulatory & Taxation Impact

5.1 Indian Equities Taxation

- Short-Term Capital Gains (STCG) (<1 year): 15%

- Long-Term Capital Gains (LTCG) (>1 year): 10% (for gains above ₹1 lakh)

5.2 Cryptocurrency Taxation

- Flat 30% tax on crypto gains (introduced in 2022)

- 1% TDS (Tax Deducted at Source) on every transaction

- Regulatory Status: As of January 2025, cryptocurrencies are not yet regulated by SEBI or RBI.

Indian equities have more favorable taxation policies, while cryptocurrencies face higher taxes and regulatory uncertainties.

PhonePe’s Upcoming IPO Details – Click Here

6. Conclusion: Which is the Better Investment?

- For long-term wealth creation: Indian equities are safer and more reliable.

- For high-risk, high-reward potential: Cryptocurrencies can amplify gains but require active monitoring.

- Ideal Approach: A diversified portfolio based on individual risk tolerance.

Final Verdict: Beginners should prioritize equities, while experts can consider a balanced mix of both asset classes.

7. FAQs

- Can I invest in both cryptocurrency and stocks at the same time?

- Yes, diversifying between equities and cryptocurrencies can help manage risk.

- How do Indian stock returns compare with crypto over 10 years?

- Indian equities have delivered an 11.3% CAGR over the past 30 years, while Bitcoin has shown higher returns with increased volatility.

- Which is better for retirement planning: Crypto or Indian equities?

- Equities are generally better for retirement due to stability, dividends, and compounding benefits.

- What are the biggest risks of investing in cryptocurrency?

- Major risks include regulatory changes, market volatility, security breaches, and fraud.

- How can I hedge risks while investing in cryptocurrency?

- Diversifying with blue-chip stocks, index funds, and traditional assets like gold can help hedge risks associated with cryptocurrency investments.

Data Source: Stock Price Archive

Data Source: StatMuse