Cryptocurrency mining has long been criticized for its environmental impact. With increasing regulatory scrutiny and investor concerns, understanding the energy consumption of mining and the transition to sustainable alternatives is crucial. This article provides an in-depth analysis of the environmental effects of cryptocurrency mining and the shift towards energy-efficient blockchain models.

The Environmental Cost of Cryptocurrency Mining

Cryptocurrency mining, particularly Proof-of-Work (PoW) mechanisms, consumes vast amounts of electricity. Bitcoin, the largest PoW-based cryptocurrency, consumes approximately 169.70 terawatt-hours (TWh) of energy per year, surpassing the annual energy consumption of entire nations like Poland.

Energy Consumption: A Closer Look

The energy consumption associated with cryptocurrency mining is staggering. Bitcoin, the pioneering cryptocurrency, is particularly notorious for its high energy demands.

- Bitcoin’s Energy Usage: As of 2021, Bitcoin’s annual energy consumption was estimated to be between 91 and 177 terawatt-hours (TWh), comparable to the electricity usage of entire countries like Argentina and the Netherlands.

- Per Transaction Consumption: Each Bitcoin transaction consumes approximately 707.6 kilowatt-hours (kWh) of electricity, an amount that could power an average U.S. household for about 24 days.

To visualize, consider the following comparison of annual energy consumption:

| Entity | Annual Energy Consumption (TWh) |

| Bitcoin | 91 – 177 |

| Argentina | 121 |

| Netherland | 109 |

Data sourced from Cambridge University and Digiconomist.

Key Environmental Concerns:

- High Carbon Footprint: The majority of Bitcoin mining occurs in regions where electricity is generated using fossil fuels.

- E-Waste Generation: Mining hardware, particularly ASIC machines, have a short lifespan, contributing to e-waste.

- Water Consumption: Cooling systems used in large mining farms consume significant water resources.

Transition to Sustainable Models

In response to environmental concerns, several cryptocurrencies have transitioned from the energy-intensive PoW mechanism to the more sustainable Proof-of-Stake (PoS) model.

Ethereum’s Transition to PoS

- Ethereum, the second-largest cryptocurrency, transitioned from PoW to PoS in September 2022, reducing its energy consumption by over 99.9%.

- This move significantly reduced Ethereum’s carbon footprint, making it more attractive to environmentally conscious investors.

Other PoS Cryptocurrencies

- Cardano (ADA), Solana (SOL), Polkadot (DOT), and Algorand (ALGO) were designed with PoS from inception, offering energy-efficient alternatives to PoW-based cryptocurrencies.

- Even Dogecoin (DOGE) transitioned to PoS in 2024, cutting its energy consumption by more than 99.9%.

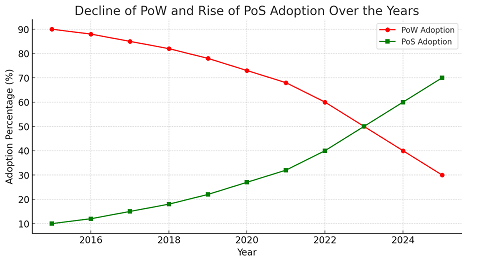

Decline of PoW and Rise of PoS Adoption

The following chart illustrates the shift from PoW to PoS in cryptocurrency adoption over the years:

Key Takeaways from the Chart:

- 2015-2020: PoW dominated the market, with Bitcoin leading the space.

- 2021-2025: A steep decline in PoW adoption occurred as more projects transitioned to PoS.

- 2022 Onwards: Ethereum’s switch to PoS accelerated the trend towards sustainable models.

Comparison of PoW and PoS Cryptocurrencies

To further clarify, here’s a comparison of major cryptocurrencies based on their consensus mechanism:

| Consensus Mechanism | Notable Cryptocurrencies | Key Insights |

| Proof-of-Work (PoW) | Bitcoin (BTC), Litecoin (LTC), Ethereum Classic (ETC), Monero (XMR), Zcash (ZEC) | Energy-intensive but highly secure. Bitcoin remains dominant. |

| Proof-of-Stake (PoS) | Ethereum (ETH), Cardano (ADA), Solana (SOL), Tezos (XTZ), Polkadot (DOT), Algorand (ALGO) | More energy-efficient and scalable. Increasing adoption. |

What Should Investors Consider?

Given the increasing global focus on sustainability, investors must consider the environmental impact of their cryptocurrency holdings. Here are key factors to keep in mind:

- Regulatory Risk: Governments may impose restrictions on PoW-based cryptocurrencies due to high energy consumption.

- Sustainability Trend: Institutional investors prefer eco-friendly investments, making PoS-based cryptocurrencies more attractive.

- Long-Term Viability: PoS-based projects offer better scalability and lower operational costs, potentially leading to better adoption rates.

Budget Month vs. Nifty 50 – Click Here

Conclusion

The environmental impact of cryptocurrency mining is a critical factor in assessing long-term investment potential. While PoW remains relevant, the trend clearly favors PoS-based cryptocurrencies due to their sustainability advantages. Investors looking for environmentally responsible and future-proof investments should closely monitor the growing adoption of PoS and the regulatory landscape around cryptocurrency mining.

FAQs

- Why is Bitcoin mining considered bad for the environment?

Bitcoin mining consumes massive amounts of electricity, leading to high carbon emissions and electronic waste, making it environmentally unsustainable. - How did Ethereum’s transition to PoS reduce its carbon footprint?

By moving from PoW to PoS in 2022, Ethereum reduced its energy consumption by over 99.9%, significantly lowering its environmental impact. - What are the most eco-friendly cryptocurrencies?

Cryptocurrencies like Cardano, Solana, Polkadot, and Algorand use PoS mechanisms, making them more energy-efficient compared to Bitcoin. - Will Bitcoin ever transition to PoS?

Bitcoin is unlikely to transition to PoS due to its decentralized governance and network security concerns. However, alternative Layer 2 solutions may improve its sustainability. - How does cryptocurrency mining compare to traditional banking in energy consumption?

While Bitcoin mining consumes more electricity than some countries, studies suggest that the traditional banking system also has a high energy footprint due to data centers, ATMs, and global financial infrastructure.