Introduction: Why Meme Coins Deserve Strategy

Meme coins aren’t just internet jokes anymore—they’re billion-dollar ecosystems. From $DOGE to $PUMP.fun tokens, traders have seen 10x to 100x returns in hours. But behind the memes lies a structured, strategic game that rewards the smart and punishes the slow.

If you’re still aping blindly, it’s time to level up with a proper crypto meme trading strategy.

This guide blends data-backed insights, wallet sniping techniques, visual chart analysis, and exit timing strategies that top degens use daily.

What Makes MemeFi Different?

⚡ Speed-Driven Markets

Meme coins move FAST. Some tokens hit peak market caps within hours of launch. Unlike traditional altcoins, there’s no slow buildup—it’s pump or perish.

💸 Community-Driven Value

Price often moves based on hype, influencers, and social momentum—not fundamentals. CT (Crypto Twitter) is your early signal.

🔥 Volatility as Opportunity

The same volatility that scares off normies creates massive profit potential for those with a clear strategy.

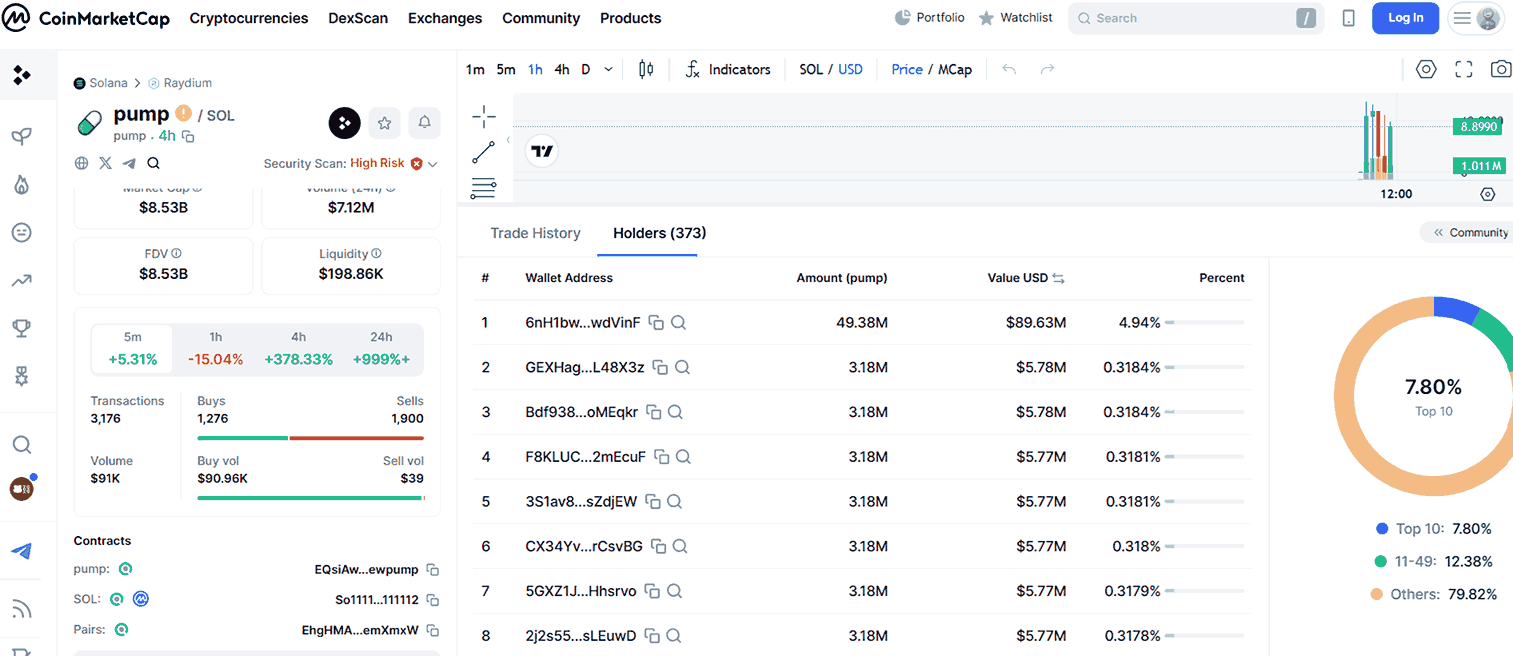

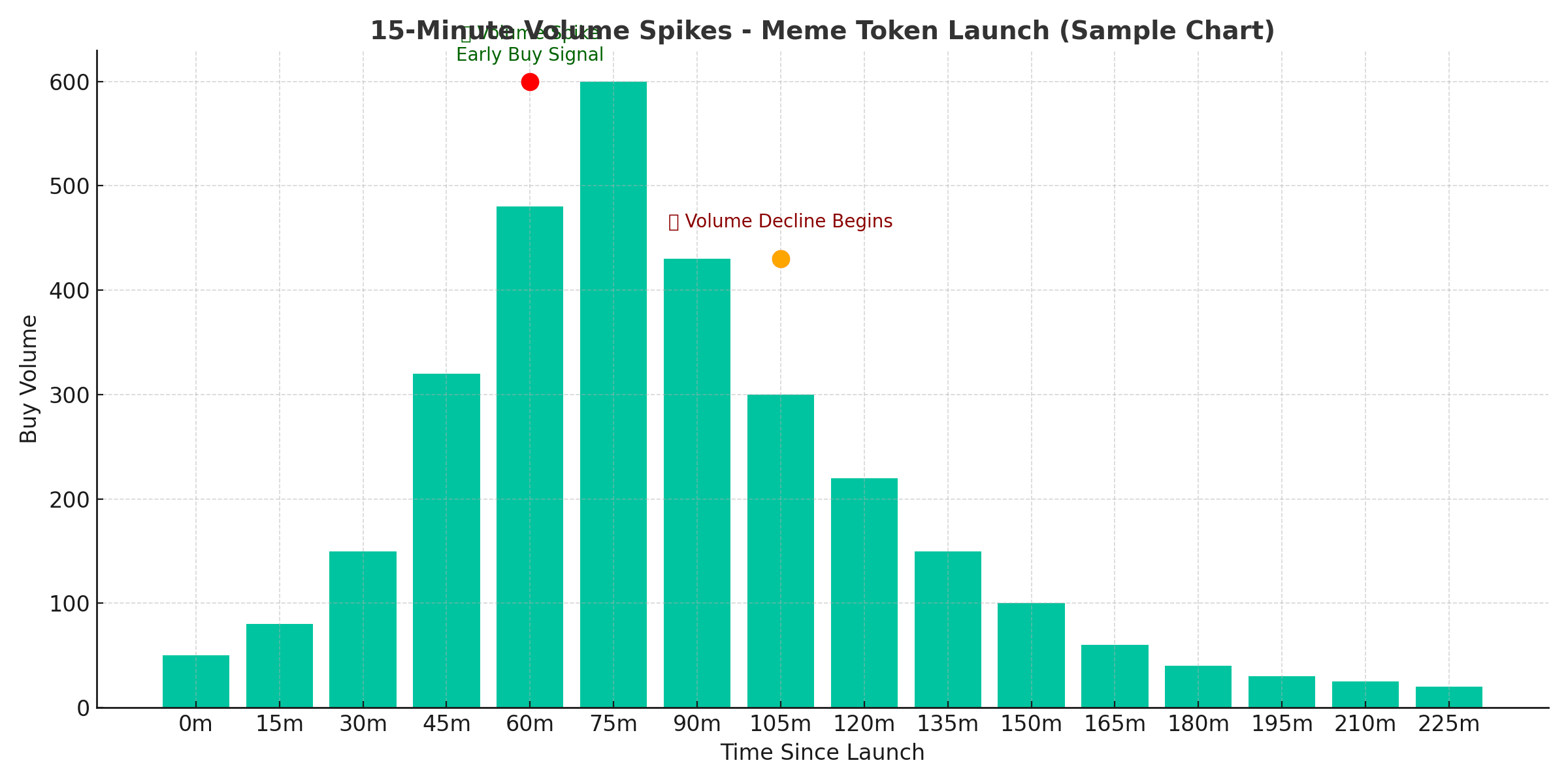

Step 1: Analyzing DEX Volume Spikes

Head over to DEXScan – Pump.fun. One of the key strategies is watching for sudden volume surges.

When buys exceed $10K in a short burst, it’s often a sign of influencers, Telegram communities, or sniping bots entering.

🧠 Pro Tip:

If the volume surge is not accompanied by rising unique wallets, it’s likely a bot-driven fakeout. Exit early.

Step 2: Identifying Wallet Entry Patterns

Wallet behavior tells the REAL story.

- Look for wallets buying at the lowest market cap levels.

- If the top 5 wallets entered under $10K mcap, they’re probably pro snipers.

- Multiple entries by same wallet across coins? You’ve found a sniper bot.

“Wallet Holding Time vs Profitability”

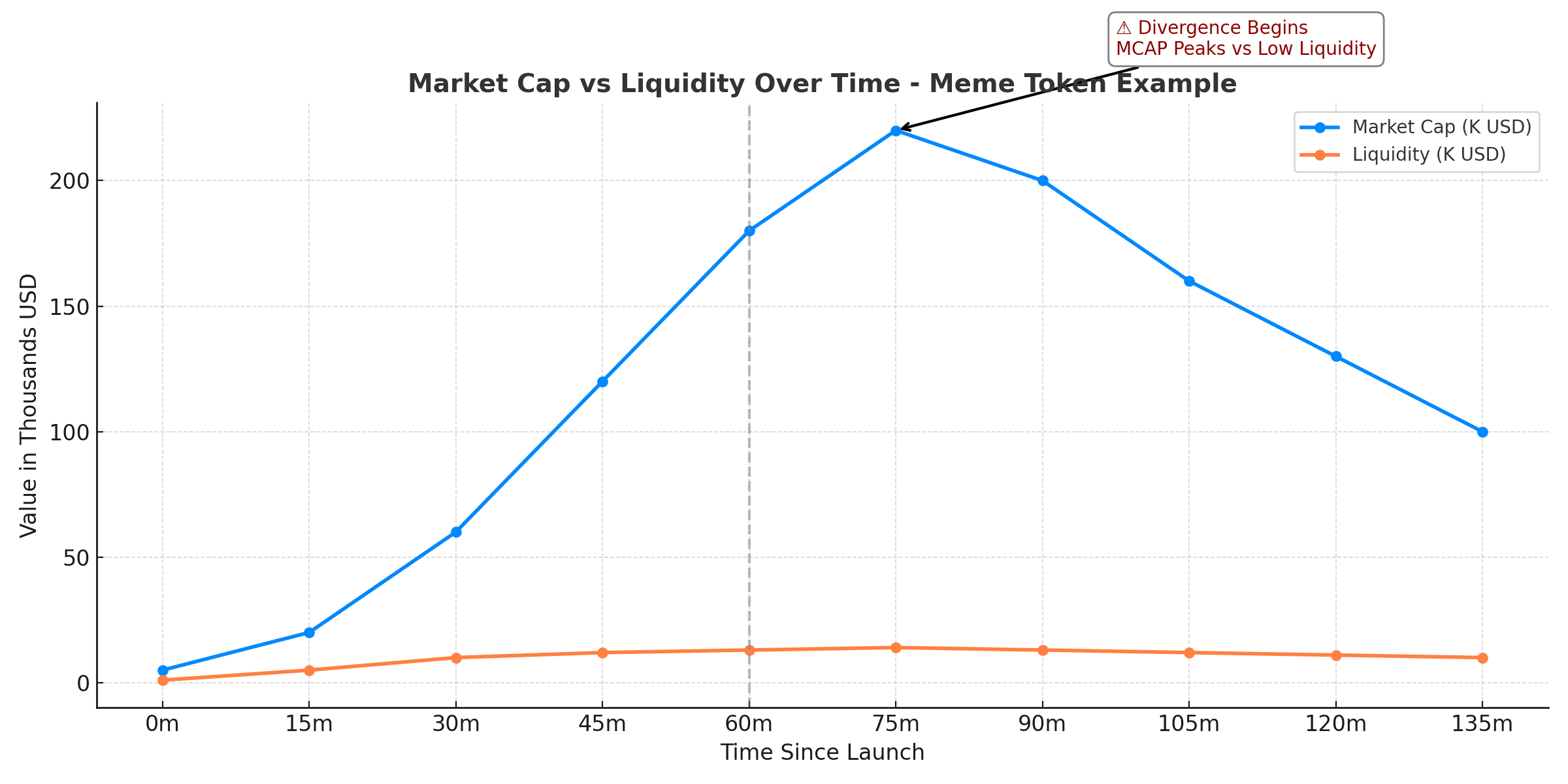

Step 3: Liquidity vs Market Cap Ratio

Exit bottlenecks happen when a token has a high market cap but low liquidity.

If a token has $500K market cap but only $10K liquidity locked, expect sharp price crashes on exits.

🧠 Smart Exit Zones:

- <25% of ATH = First Exit

- 50% of ATH = Partial Exit

- 80% of ATH = Full Exit

Step 4: Timing the Exit Before the Dump

Exit strategy is the most underrated part of meme trading. Most memes lose -80% value post-ATH.

🔥 Trailing Exit Method:

- Sell 25% every 8 hours post ATH

- Add more exits if volume drops by >30%

Remember: if CT is euphoric, you’re already late.

Step 5: Wallet Sniping Strategies

Wallet snipers dominate early-stage meme coins. Here’s how:

🎯 Tools Used:

- MEV bots

- Telegram alerts

- Gas speed optimizers

Snipers often exit in 1-3 candles. Don’t chase them—learn from their timing.

🧠 Tip:

Track wallets that enter multiple tokens at exact intervals—these are likely MEV-backed bots.

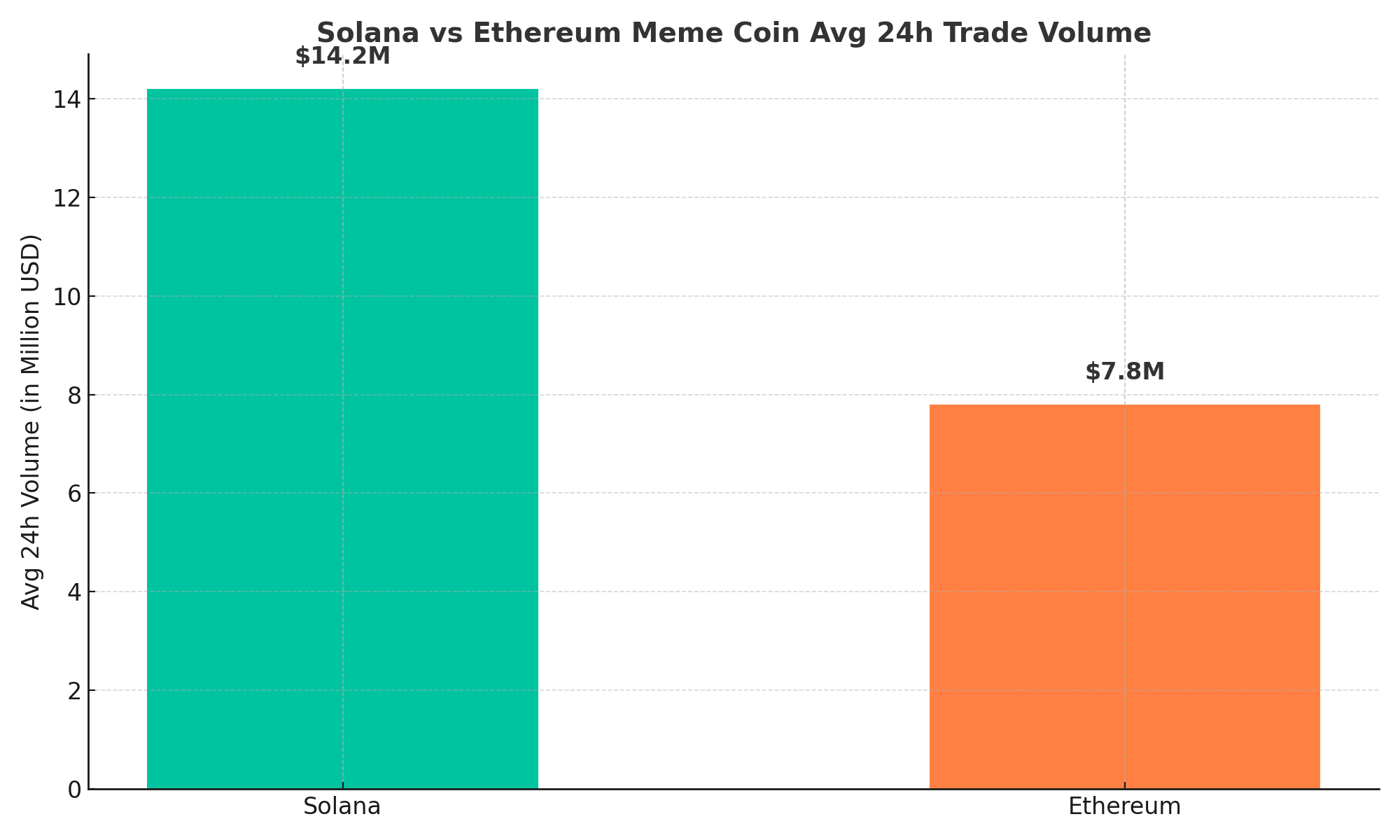

Step 6: Solana vs Ethereum in MemeFi

✅ Solana Advantage:

- Super cheap gas (~$0.00025)

- Lightning-fast execution

- Ideal for bots & snipers

✅ Ethereum Edge:

- Stronger whales

- Deeper LPs

- Slower, more sustainable meme cycles

Choose your chain based on your risk appetite & trading speed preference.

Step 7: Psychological Game of MemeFi

Success in MemeFi is part data, part psychology:

- Don’t ape at peak FOMO

- Exit when influencers start posting “we’re still early”

- Track sentiment shifts on Telegram & X

Conclusion: Build Your MemeFi Alpha Stack

Winning in memes isn’t about luck—it’s about strategy.

✅ Read DEX volume & wallets ✅ Exit before peak hype ✅ Sniff sniper behavior ✅ Use the right chain

For more tools, visuals & pro-level breakdowns → visit [YourSite.com]

Share this with your degen group. Alpha shared = Alpha returned. 🧠💥

Meme Token Trading Explained – Click Here

FAQs: Crypto Meme Trading Strategy

Q1: What is the best time to exit a meme coin?

A: Exit 25-50% near ATH or when volume drops by >30% within 8-12 hours.

Q2: How can I detect sniper wallets?

A: Watch for early entries at low market cap, repeated wallet IDs, and high-speed transactions.

Q3: Is Solana better than Ethereum for meme trading?

A: Solana is better for fast flips; Ethereum offers more stability and liquidity.

Q4: What is the risk in low LP meme coins?

A: Low liquidity makes it hard to exit and leads to massive price crashes with small sells.

Q5: Can beginners succeed in MemeFi?

A: Yes, with proper strategies, tools like DEXScan, and risk control, even beginners can profit.