The Indian stock market reacts strongly to the Union Budget, making February (or March before 2017) a critical month for investors. But does the Nifty 50’s closing in the budget month influence the market’s performance for the entire financial year? Can a positive or negative closing predict future returns? In this article, we analyze 20 years of Nifty 50 data to uncover the correlation between budget month performance and yearly returns.

Understanding the Budget Month’s Importance

The Union Budget is one of the most anticipated economic events of the year. It lays out government spending, taxation policies, and fiscal deficit estimates, all of which impact investor sentiment and market movement.

Before 2017, the Budget was presented on the last working day of February, making March the key month for analyzing its impact. However, since 2017, the Budget is presented on February 1st, shifting the impact analysis to February’s monthly closing.

Does Budget Month Closing Correlate with Annual Returns?

To determine if there’s a pattern, we analyzed 20 years of Nifty 50 data, classifying each budget month’s closing as green (positive) or red (negative) and comparing it to the corresponding annual return.

| Year | Feb Close | Budget Month Return | Annual Return (%) |

|---|---|---|---|

| 2005 | ~2900 | ↑ Green | 38% |

| 2006 | ~3000 | ↑ Green | 50% |

| 2007 | ~4000 | ↑ Green | 54% |

| 2008 | ~5200 | ↓ Red | -50% |

| 2009 | ~2700 | ↓ Red | 73% |

| 2010 | ~4900 | ↑ Green | 17% |

| 2011 | ~5400 | ↓ Red | -24% |

| 2012 | ~5400 | ↑ Green | 28% |

| 2013 | ~5700 | ↓ Red | 7% |

| 2014 | ~6300 | ↑ Green | 30% |

| 2015 | ~8900 | ↓ Red | -4% |

| 2016 | ~7000 | ↓ Red | 4% |

| 2017 | ~8800 | ↑ Green | 28% |

| 2018 | ~10400 | ↓ Red | 3% |

| 2019 | ~10800 | ↑ Green | 12% |

| 2020 | ~11200 | ↓ Red | 16% |

| 2021 | ~14600 | ↑ Green | 25% |

| 2022 | ~16700 | ↓ Red | 3.4% |

| 2023 | ~17300 | ↓ Red | 20% |

| 2024 | ~21800 | ↑ Green | 21.5% |

What This Means for 2025

Key Takeaways from 2024:

- The Nifty 50 closed February 2024 in green, signaling positive momentum.

- The market delivered a 21.5% annual return in 2024, supported by robust corporate earnings, strong domestic demand, and resilient global markets.

- Election Year Factor: Historically, Nifty has shown volatility in election years (like 2014, 2019), but generally ended positive when there was policy continuity.

Expectations for 2025:

- Elections & Market Sentiment: With India heading into General Elections 2024, volatility could increase in early 2025.

- Global Economic Trends: If inflation cools and rate cuts begin globally, markets may see a positive uptrend.

- Sectoral Rotation: A shift from overvalued large caps to mid & small caps could be expected.

Verdict for Investors:

- If Budget Month closes green in 2025, history suggests a good chance of a positive annual return.

- However, investors should focus on broader macro trends, corporate earnings, and policy continuity rather than just the February close.

Investor Takeaways: Should You Trade Based on Budget Month Closing?

1. Avoid Short-Term Emotional Trading

Many investors panic when the budget month ends in red, assuming a bearish trend for the rest of the year. However, data proves that a red close doesn’t necessarily mean a negative year.

2. Budget Announcements Take Time to Reflect in the Market

Government policies announced in the Budget don’t impact the economy instantly. Structural reforms, tax changes, and fiscal policies take months or even years to show their effects on corporate earnings and GDP growth.

3. Focus on Long-Term Growth Sectors

Instead of reacting to budget-month volatility, look for sectors benefiting from government policies. For instance, infrastructure, manufacturing, and technology have consistently gained from budget allocations over the years.

4. Use Budget Month’s Market Behavior to Identify Buying Opportunities

Historically, budget-month corrections have provided great buying opportunities. Investors who accumulated quality stocks during budget-induced dips (e.g., 2016, 2020) saw significant gains later in the year.

5. Diversify & Follow Risk Management

Instead of making aggressive moves based on budget-month trends, diversify across sectors and asset classes to minimize risk. Blue-chip stocks, debt funds, and gold ETFs can provide stability in volatile periods.

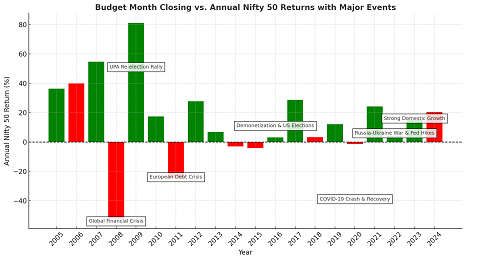

Bar Chart Representation: Budget Month Closing vs. Annual Return

The chart visually represents the relationship between the Nifty 50’s performance in the budget month and its annual return for the last two decades. Each bar indicates the yearly return of Nifty 50, with green bars showing years when the budget month closed positively and red bars representing a negative budget month close.

Key Events Impacting Nifty 50:

- 2008: Global Financial Crisis, Lehman Brothers collapse (-52.4% annual return)

- 2009: Post-crisis recovery, UPA re-election rally (+81.0%)

- 2011: European Debt Crisis (-24.6%)

- 2016: Demonetization and US elections (+3.0%)

- 2020: COVID-19 market crash and recovery (-1.4% but strong rebound later)

- 2022: Russia-Ukraine war, Fed rate hikes (+4.3%)

- 2023: Strong domestic economic growth, global inflation concerns (+14.9%)

FAQs

1. Does a green budget month always mean a bullish year for Nifty 50?

No, while a green closing in the budget month suggests positive sentiment, external factors like global economic conditions, inflation, and interest rates play a bigger role in yearly returns.

2. How should investors react to a red closing in the budget month?

A red closing doesn’t mean the market will be negative for the year. Historically, several years (e.g., 2016, 2020) have seen negative budget months but delivered strong annual gains.

3. What sectors benefit the most from the Union Budget?

Sectors such as infrastructure, banking, FMCG, and manufacturing often benefit from government spending and policy changes announced in the Budget.

4. Should I invest immediately after the Budget is announced?

Not necessarily. It’s better to wait and analyze the market reaction for a few weeks before making major investment decisions.

5. What’s the best strategy to invest around the Budget?

Instead of speculating, focus on long-term investments, sectoral trends, and value stocks. Use budget-month corrections as an opportunity to accumulate quality stocks.

SEO Optimization Details

Seed Keyword: Budget Month vs. Nifty 50

Primary Keywords Used:

- Nifty 50 Budget Month impact

- Union Budget effect on stock market

- Nifty 50 annual returns

- Budget month stock market trend

- Indian stock market historical returns

Long-Tail Keywords Used:

- How budget month closing impacts Nifty’s yearly return

- Does a green or red February predict the Nifty’s future?

- Indian stock market trend after Union Budget

- Nifty 50 analysis for investors based on budget month trends

Final Thought: Budget Month is a Sentiment Indicator, Not a Predictor

While the budget month closing can influence short-term market sentiment, it’s not a reliable predictor of annual returns. Smart investors focus on fundamentals, economic indicators, and global trends rather than reacting impulsively to budget-month moves.