Weekly Chart Highlights Bullish Breakout

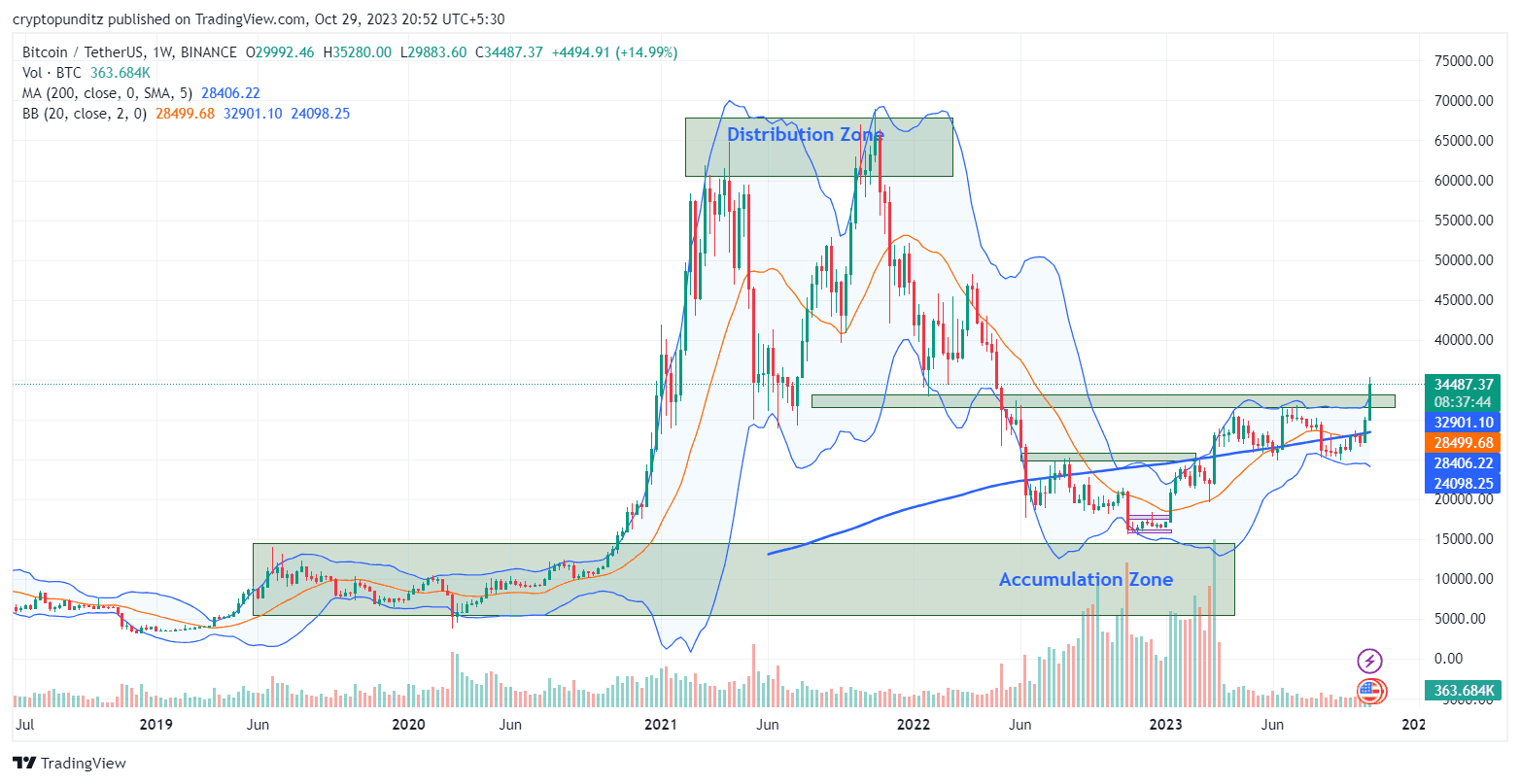

In a significant move, BTCUSDT showcased a robust breakout from its critical resistance zone of USD 32,000-33,000, accompanied by substantial trading volumes on the weekly chart. This breakout not only signifies a bullish sentiment surge in the coin but also marks a notable achievement as it successfully closed above its key moving averages — the 20-day and 200-day Simple Moving Averages (SMA).

Key Trends and Caution for Traders

While these developments are promising, it’s crucial for traders to exercise caution, considering the overarching sideways trend in BTCUSDT. The ongoing bull run could lose momentum rapidly. To navigate this, traders need to closely monitor the USD 33,000 level. Sustaining above this point may propel BTCUSDT towards the USD 50,000 mark. On the flip side, a significant support zone is established at USD 28,000.

Daily Charts Suggest Potential Retest

Examining the daily charts reveals the possibility of BTCUSDT revisiting its breakout zone, formerly a substantial resistance area. This retracement is a common occurrence in the aftermath of a robust rally. Traders can interpret this as a strategic opportunity to gradually build their positions in the coin.

In summary, the recent breakout in BTCUSDT on the weekly chart is a strong indicator of bullish momentum. However, traders should remain vigilant due to the prevailing sideways trend, and the potential for a retest on the daily charts. Staying above USD 33,000 is critical for a sustained upward trajectory, while USD 28,000 serves as a significant support level in case of a downturn.

Also Read- BitCoin in Tradingview- Multiple time frame Analysis

Trending News – Grayscale Spot ETF Decision: U.S. SEC Does Not Plan To Appeal Court Decision

Disclaimer :

CryptoPunditz.com is not a registered investment, legal, or tax advisor or a broker/dealer. All investment/financial opinions expressed by CryptoPunditz.com are from the personal research and experience of the owner of the site and are intended as educational material. Although best efforts are made to ensure that all information is accurate and up to date, occasionally unintended errors and misprints may occur.